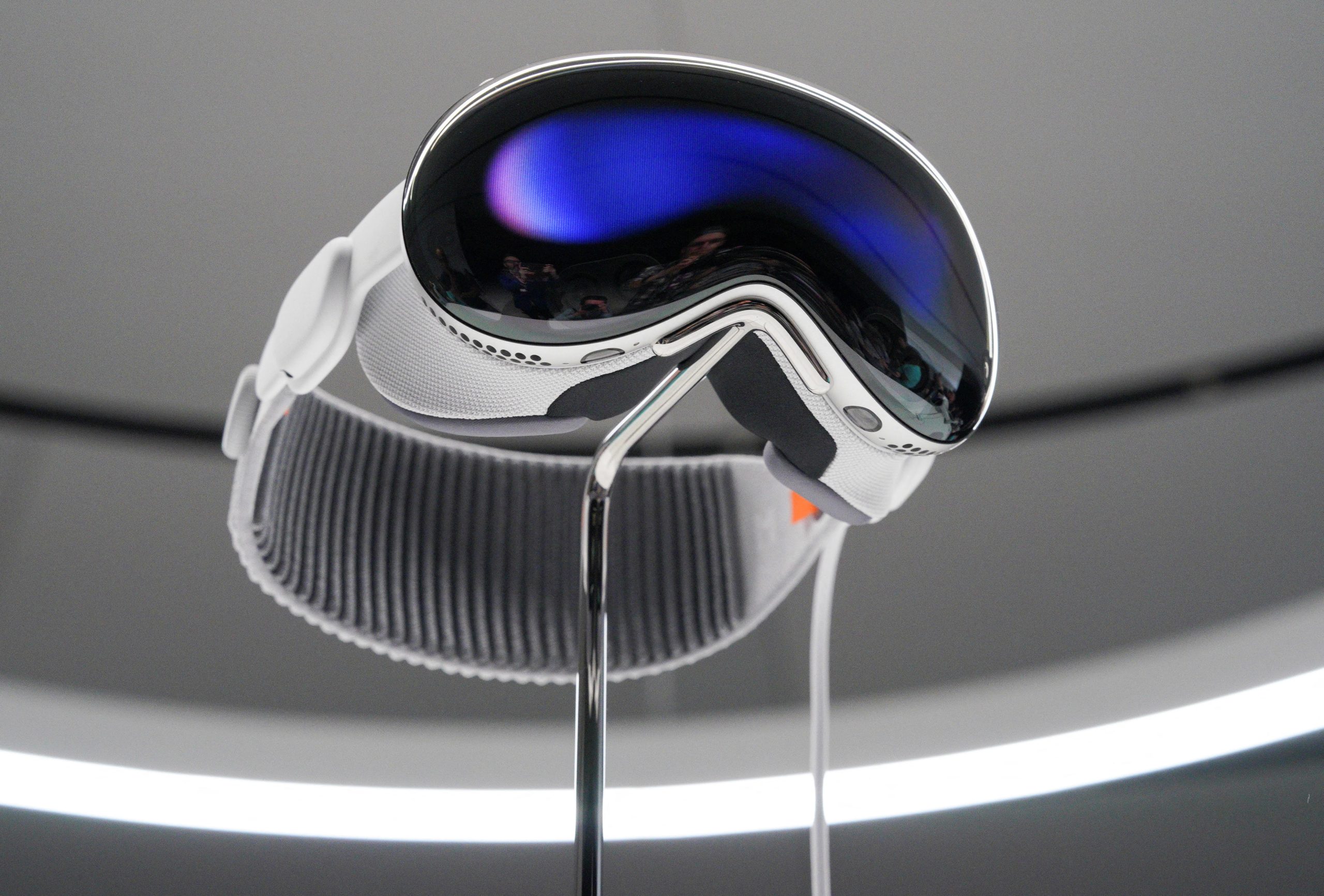

Everything you need to know about Apple’s new Vision Pro headset

-

Shows3 days ago

Shows3 days agoThe power and benefit of green antitoxins

-

News5 days ago

News5 days agoThe TikTok ban was just passed by the House. What could happen next?

-

News5 days ago

News5 days agoTechnological terror: China reveals uncanny AI romance film

-

News5 days ago

News5 days agoGrindr application cruises into court over privacy concerns

-

Shows3 days ago

Shows3 days agoUnveiling the Bitcoin halving

-

Leaders5 days ago

Leaders5 days agoHow to overcome imposter syndrome in the workplace

-

News3 days ago

News3 days agoThreading the needle: Meta’s new platform finally dethrones X

-

News3 days ago

News3 days agoZendaya is serving in saucy sports drama “Challengers”