Money

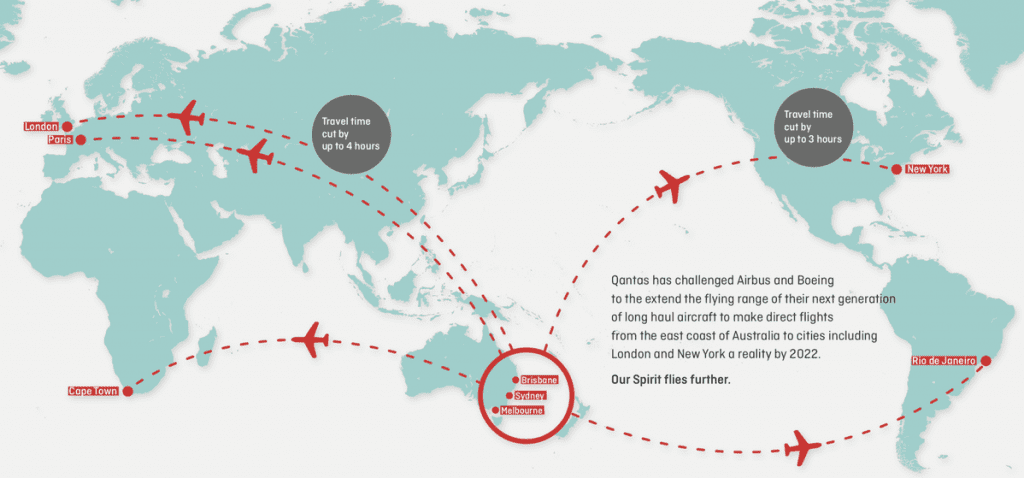

Will Qantas return to London before Perth?

Money

RBA rate shock: ASX200, Gold and Crypto market

RBA’s interest rate shift impacts ASX200, AUD; gold/silver rebound analyzed amidst upcoming economic data and crypto market navigation.

Money

Dow hits record while tech stocks drive market gains

S&P 500 rose 0.7% with Nvidia and Broadcom driving gains; investors await delayed January jobs and inflation reports.

Money

Tech stocks slide as investors rotate into small-cap and value plays

Nasdaq drops 1.84% amid turbulent week; investors pivot to cyclical and value sectors from high-growth tech.

-

News4 days ago

News4 days agoU.S. ramps up Cuba aid as energy crisis deepens

-

Tech4 days ago

Tech4 days agoOpenAI and Anthropic launch faster, smarter AI tools for enterprise coding

-

News4 days ago

News4 days agoSpaceX expands Starlink with phone plans and satellite tracking ambitions

-

Ticker Views4 days ago

Ticker Views4 days agoRebuilding Gaza: Lessons from the Phoenix Plan

-

Money4 days ago

Money4 days agoU.S. markets mixed as tech slumps and Fed moves spark uncertainty

-

Ticker Views1 day ago

Ticker Views1 day agoIsraeli President Herzog visits Australia amid rising antisemitism

-

Money4 days ago

Money4 days agoTech stocks and Bitcoin tumble amid market uncertainty and rising job concerns

-

Tech1 day ago

Tech1 day agoClaude AI is transforming software engineering and productivity