Tech

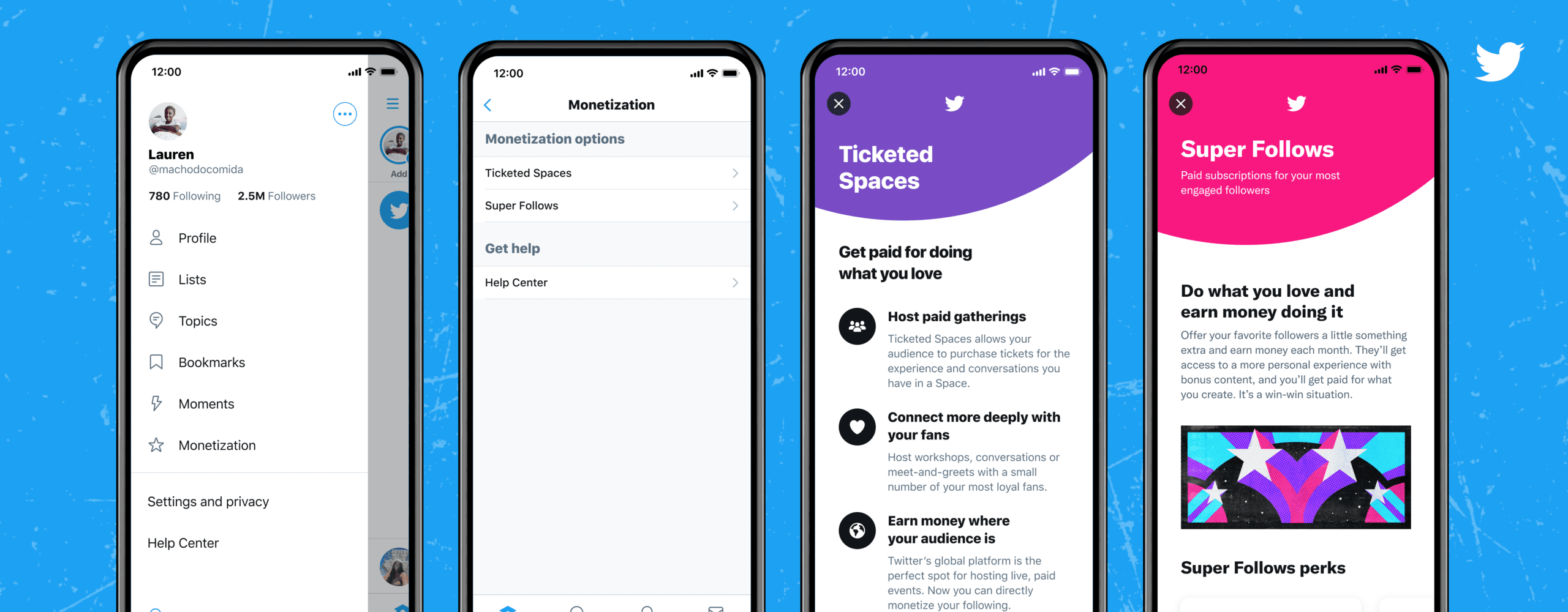

Ticketed Spaces & Super Followers: Here’s how to make bank on Twitter

Tech

Ariane 64 takes flight carrying Amazon’s broadband satellites

Ariane 64’s maiden launch from French Guiana carries 32 Amazon satellites, starting 18 missions to enhance global broadband access.

Tech

SpaceX shifts focus to Moon with ambitious Lunar City plans

Elon Musk shifts SpaceX focus from Mars to a 2027 Moon landing, merging with xAI for AI satellite networks.

Tech

Claude AI is transforming software engineering and productivity

Anthropic’s Claude AI now manages coding tasks, boosting productivity by 50% as engineers shift to oversight roles.

-

Ticker Views3 days ago

Ticker Views3 days agoIsraeli President Herzog visits Australia amid rising antisemitism

-

Tech3 days ago

Tech3 days agoClaude AI is transforming software engineering and productivity

-

News4 days ago

News4 days agoRussia missile strikes force Ukraine nuclear plants offline amid safety fears

-

News3 days ago

News3 days agoJapan election delivers commanding win for ruling LDP

-

Money3 days ago

Money3 days agoTech stocks slide as investors rotate into small-cap and value plays

-

Ticker Views2 days ago

Ticker Views2 days agoU.S. ambassador responds to NATO criticism at Munich Security Conference

-

News4 days ago

News4 days agoTrump lifts India tariffs after New Delhi halts Russian oil imports

-

Ticker Views20 hours ago

Ticker Views20 hours agoLunar Gateway faces delays and funding debate amid Artemis ambitions