News

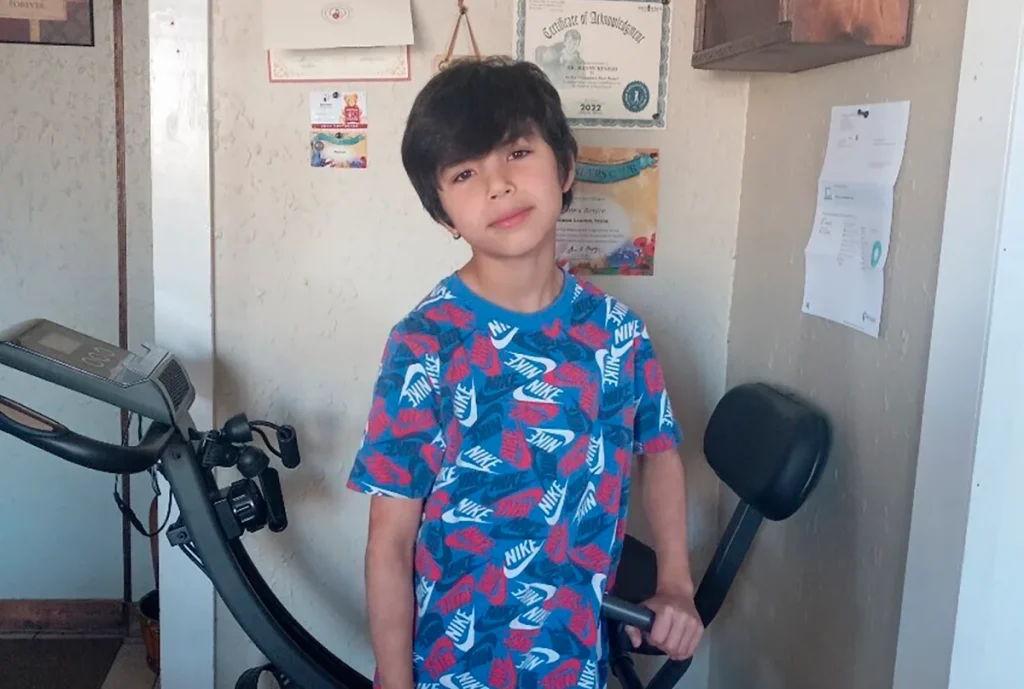

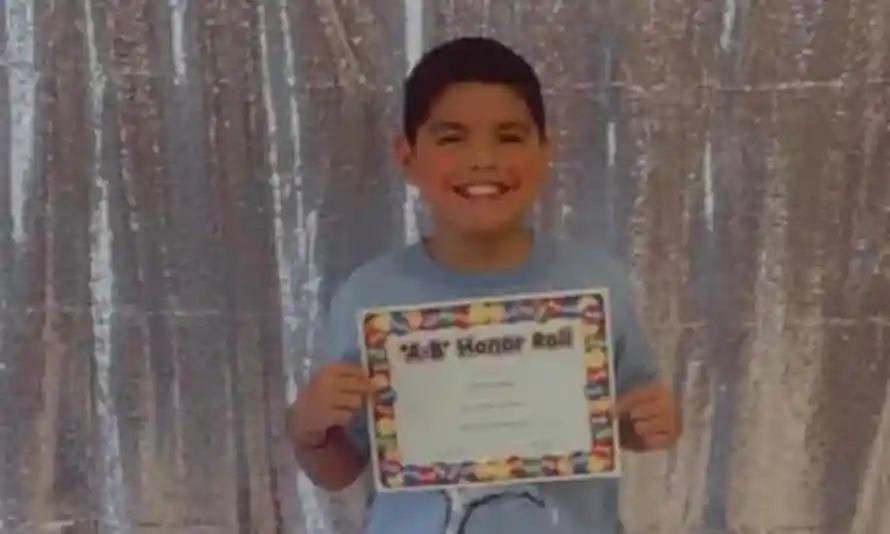

‘My heart will forever break for you’- Families grieve as veil is lifted on identity of victims

News

LIVE: U.S. and Israel launch war on Iran

U.S. and Israel escalate conflict with Iran, heightening regional war fears for the second time in eight months.

News

Trump claims Iran military neutralised as Strait Of Hormuz tensions surge

Trump claims Iran’s military largely neutralized; tensions rise with attacks threatening air travel and oil shipping.

News

Airlines face disruptions that surpass previous Middle East conflicts

-

News4 days ago

News4 days agoCrude oil prices spike amid U.S.-Israel military action

-

News4 days ago

News4 days agoIran warns ships to avoid Strait of Hormuz

-

News2 days ago

News2 days agoAirlines face disruptions that surpass previous Middle East conflicts

-

News4 days ago

News4 days agoU.S. and Israel attack Iran, escalating regional conflict

-

News4 days ago

News4 days agoMarkets brace for turmoil after U.S. strikes Iran

-

Leaders2 days ago

Leaders2 days agoNina Hargrave’s journey to Serene Body Health

-

Shows3 days ago

Shows3 days agoUnderstanding commercial lending’s unique challenges and strategies

-

Shows3 days ago

Shows3 days agoCities reshaped by capital, policy, and design insights