News

IPL suspended: Will cricketers remain banned from travelling back to Aus?

News

NASA’s Artemis II launch: Argentina joins first crewed moon mission in 50 years

NASA’s Artemis II rocket is ready for its first crewed Moon mission in over 50 years, featuring Argentina’s ATENEA microsatellite.

News

Iran warns U.S. retaliation as protest death toll soars — executions feared, nationwide unrest

Iran warns of severe retaliation against U.S. strikes, amid escalating tensions and internal unrest.

News

EU condemns Trump’s Greenland tariff threats: Trade tensions escalate

Major EU nations criticize Trump’s Greenland tariffs as “blackmail,” risking trade agreements and raising tensions across the Atlantic.

-

Ticker Views4 days ago

Ticker Views4 days agoGlobal power struggles and Arctic shipping risks

-

Leaders4 days ago

Leaders4 days agoSendle’s closure impacts Australia’s small business logistics

-

News5 days ago

News5 days agoIran protests and the global fight for freedom

-

Money5 days ago

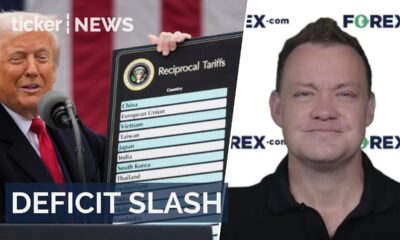

Money5 days agoU.S. budget deficit falls to $1.67 trillion

-

Docos5 days ago

Docos5 days agoTrump threatens to take Greenland as NATO crisis erupts

-

News5 days ago

News5 days agoU.S. moves personnel from Qatar base amid Iran tensions

-

Tech5 days ago

Tech5 days agoX restricts Grok AI as global backlash grows

-

Tech4 days ago

Tech4 days agoTSMC posts record profits on AI chip boom