Money

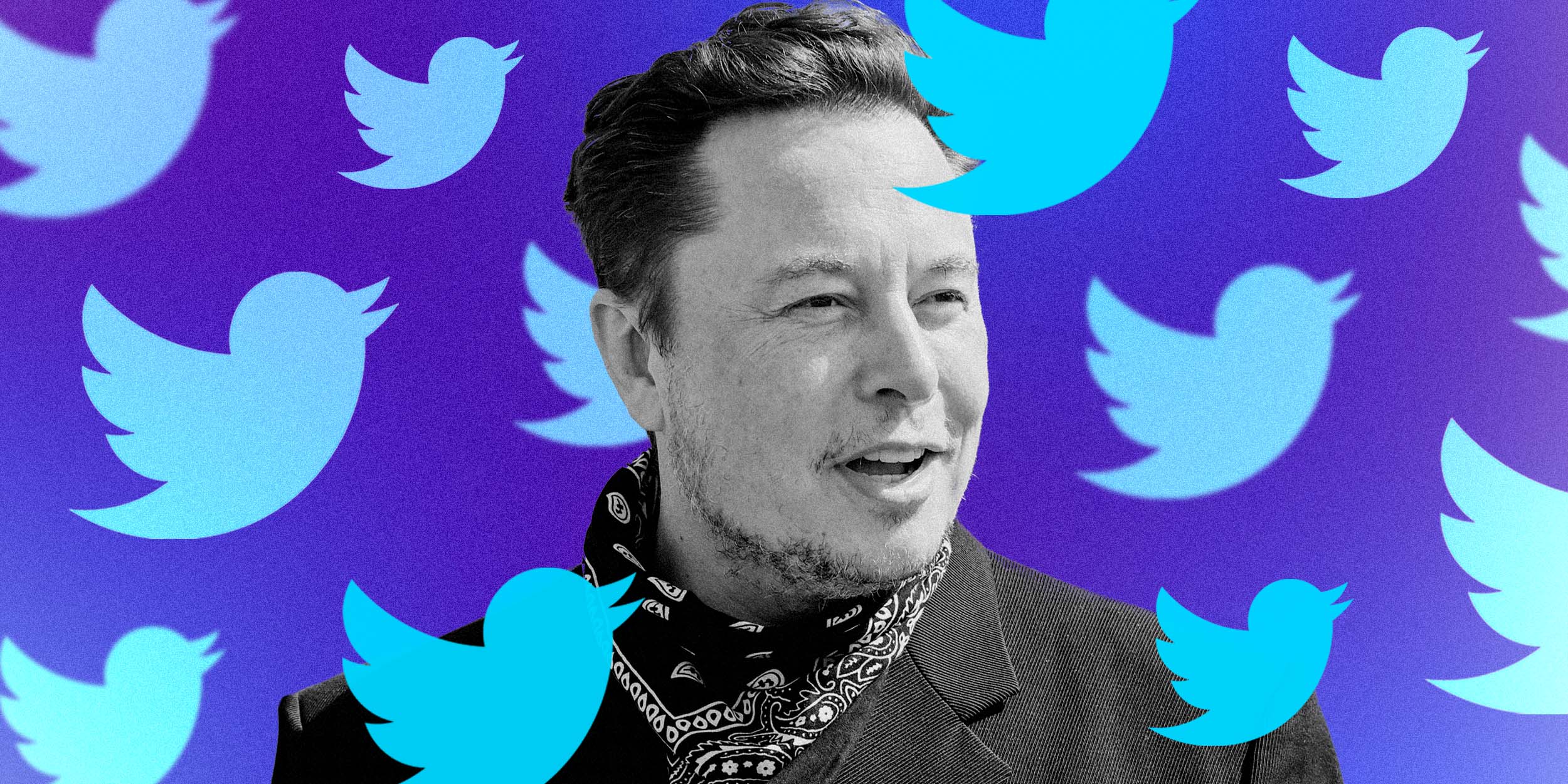

Elon Musk buys Twitter for $44 billion

Money

Markets tumble as Trump tariffs, Greenland rhetoric and Europe backlash collide

U.S. stocks plummet over 800 points amid renewed tariff threats and political tensions from Trump, sparking global trade concerns.

Money

Gold hits record highs as investors flee risk

Gold surges amid global uncertainty, with February futures rising 1.71% to $4,674.20 per ounce, signaling safe-haven demand.

Money

Markets edge higher as 10-year yields hit new highs

Major stock indices rise slightly; 10-year Treasury yield hits 4.23% amid Fed Chair speculation, affecting small and mega-cap stocks.

-

Ticker Views3 days ago

Ticker Views3 days agoDOJ to charge Don Lemon under historic KKK Act

-

Ticker Views2 days ago

Ticker Views2 days agoBacklash over AI “Indigenous Host” sparks ethical debate

-

News3 days ago

News3 days agoOpenAI prepares first consumer device amid revenue boom

-

Money4 days ago

Money4 days agoMarkets edge higher as 10-year yields hit new highs

-

Ticker Views20 hours ago

Ticker Views20 hours agoMarket Watch: Greenland deals, Japan bonds & Australia jobs

-

News4 days ago

News4 days agoNASA’s Artemis II launch: Argentina joins first crewed moon mission in 50 years

-

Politics4 days ago

Politics4 days agoSupreme Court tariffs and Albanese approval drop: What you need to know

-

News4 days ago

News4 days agoEU condemns Trump’s Greenland tariff threats: Trade tensions escalate