Money

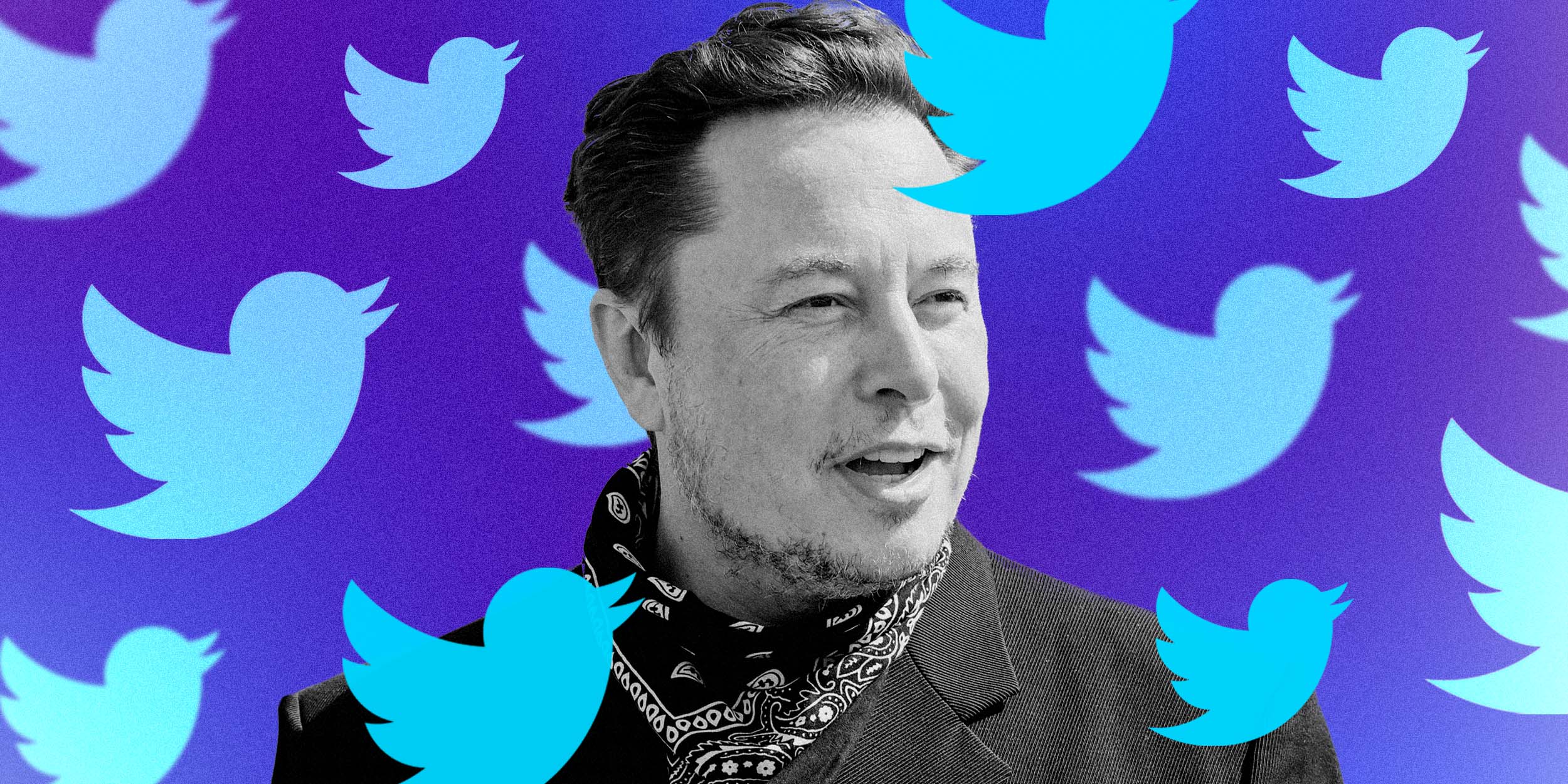

Twitter shares fall as Musk turns to Chuck Norris

Money

Australian Dollar surges: What $0.70 means for markets

Australian dollar surges 5% to $0.70, impacting importers, exporters, and big miners amid rising interest rates.

Money

S&P 500 rises as financial stocks lead and tech slips

S&P 500 rises 0.4% thanks to financial stocks; software struggles amidst AI concerns. Subscribe for updates!

Money

Australia’s GST debate heats up amid tax reform push

Australia debates GST expansion amid aging population pressures and personal income tax concerns; expert insights from Dr. Steven Enticott.

-

Shows3 days ago

Shows3 days agoReal estate insights: Technology changes and trust remain

-

News3 days ago

News3 days agoOne Nation matches coalition as Liberal backing slides

-

Tech3 days ago

Tech3 days agoCrew-12 astronauts arrive at the International Space Station

-

News5 days ago

News5 days agoSheriff Nanos dismisses evidence claims in Nancy Guthrie case update

-

Money3 days ago

Money3 days agoAI fears rattle global markets and investors

-

Shows3 days ago

Shows3 days agoMedicinal Cannabis reform: Patient demand vs regulatory hurdles in Australia

-

Ticker Views2 days ago

Ticker Views2 days agoGlobal rallies show support for Iran as sanctions and tensions rise

-

Ticker Views2 days ago

Ticker Views2 days agoTrump scraps key climate law, U.S. emissions regulation at risk