News

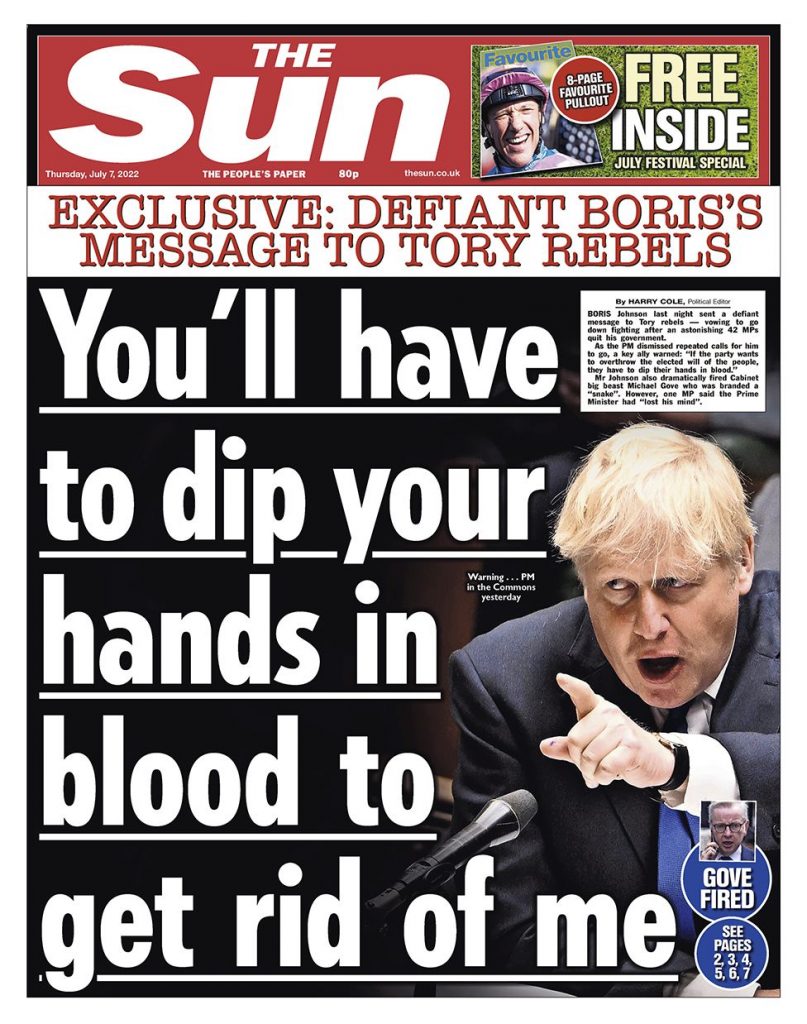

British Prime Minister defies calls to resign

News

Iran live updates: Trump claims Khamenei dead as Iran insists he remains in command

News

U.S. and Israel strike Iran as missiles hit Gulf bases and oil surges

U.S. and Israel launch major military operation against Iran; tensions rise as conflict escalates, impacting global markets.

News

Iran warns ships to avoid Strait of Hormuz

Iran warns ships to avoid Strait of Hormuz amid rising tensions and military buildup in the region

-

Tech5 days ago

Tech5 days agoOpenAI moves to replace software giants with AI products

-

Money4 days ago

Money4 days agoAustralia’s inflation report and Nvidia earnings impact explained

-

Tech3 days ago

Tech3 days agoMeta launches lawsuits over alleged scam advertising operations

-

Tech4 days ago

Tech4 days agoNvidia earnings soar as AI drives 75% revenue growth

-

News4 days ago

News4 days agoQantas announces 8,500 jobs and frequent flyer changes

-

News1 day ago

News1 day agoU.S. and Israel attack Iran, escalating regional conflict

-

News19 hours ago

News19 hours agoIran warns ships to avoid Strait of Hormuz

-

News1 day ago

News1 day agoCrude oil prices spike amid U.S.-Israel military action