Money

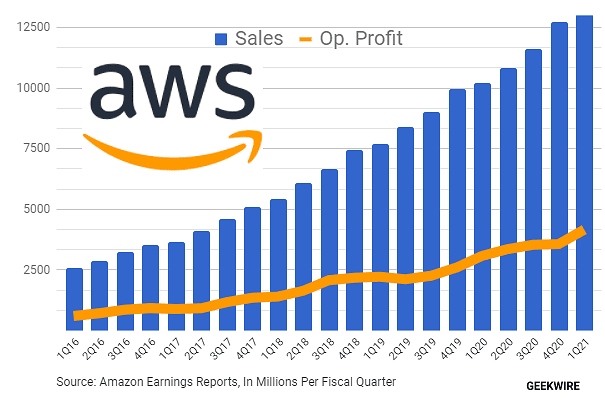

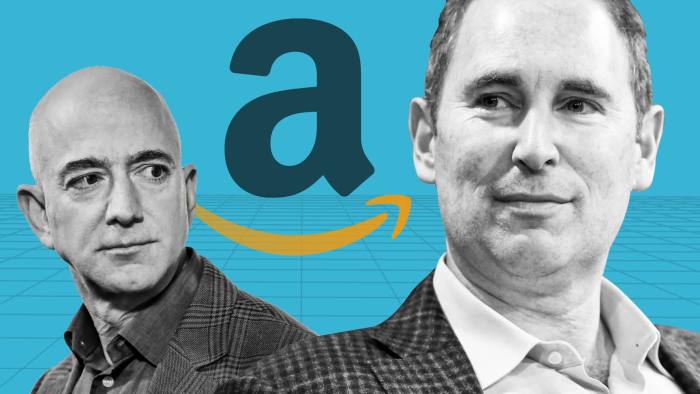

Jeff Bezos resigns: will new CEO Andy Jassy jazz things up at Amazon?

Money

U.S. jobs report, Fed decisions, and Japan’s economic risks explained

January US jobs report sparks uncertainty; analysts debate impact on Federal Reserve policy and market confidence.

Money

Alphabet launches $20B bond to fund AI expansion

Alphabet’s $20B bond offering highlights investor confidence in AI growth, enabling funding without shareholder dilution.

Money

AI tax tool sparks market turmoil for financial firms

Major financial firms’ stocks fell sharply after an AI tax tool launch, raising investor fears of disruption in advisory services.

-

Ticker Views3 days ago

Ticker Views3 days agoIsraeli President Herzog visits Australia amid rising antisemitism

-

Tech3 days ago

Tech3 days agoClaude AI is transforming software engineering and productivity

-

News4 days ago

News4 days agoRussia missile strikes force Ukraine nuclear plants offline amid safety fears

-

News3 days ago

News3 days agoJapan election delivers commanding win for ruling LDP

-

Money3 days ago

Money3 days agoTech stocks slide as investors rotate into small-cap and value plays

-

Ticker Views2 days ago

Ticker Views2 days agoU.S. ambassador responds to NATO criticism at Munich Security Conference

-

News4 days ago

News4 days agoTrump lifts India tariffs after New Delhi halts Russian oil imports

-

Ticker Views20 hours ago

Ticker Views20 hours agoLunar Gateway faces delays and funding debate amid Artemis ambitions