Tech

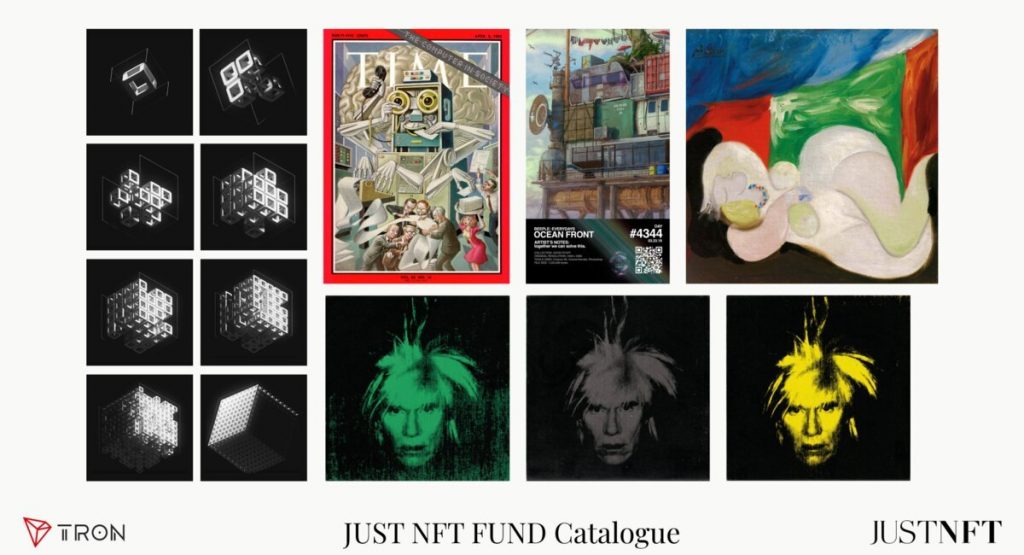

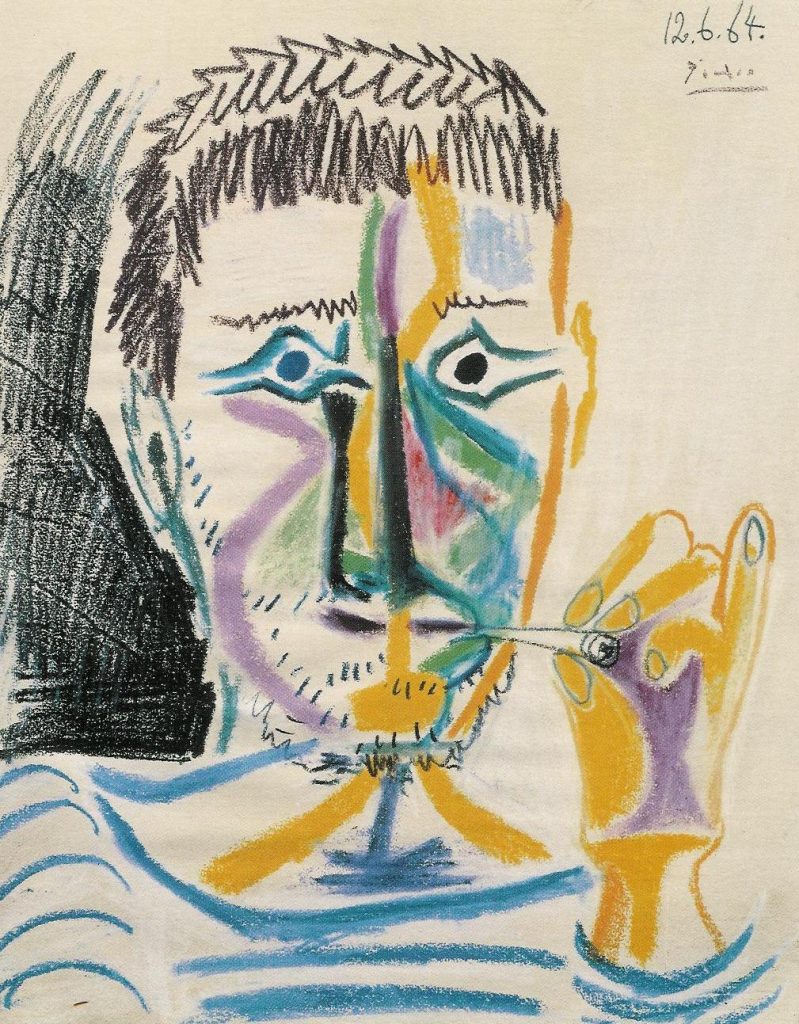

World First: how to own shares in a Picasso masterpiece

Tech

OpenAI and Anthropic launch faster, smarter AI tools for enterprise coding

OpenAI and Anthropic launch advanced coding models, revolutionizing enterprise software development and intensifying the AI tooling competition.

Tech

Nvidia and Amazon explore massive OpenAI funding round

Nvidia CEO downplays $100B OpenAI investment, as Amazon eyes $50B stake in AI startup

News

Big Tech earnings spark investor unease over AI spending

Investors monitor Big Tech’s AI investments, with Meta thriving while Microsoft and Tesla face uncertainty over growth and returns.

-

Ticker Views4 days ago

Ticker Views4 days agoElon Musk merges SpaceX and xAI to create solar-powered AI data centres

-

Ticker Views4 days ago

Ticker Views4 days agoRBA interest rate increase explained – impact on Australians

-

News2 days ago

News2 days agoU.S. ramps up Cuba aid as energy crisis deepens

-

News3 days ago

News3 days agoAmazon launches AI tools to change film and television production

-

News4 days ago

News4 days agoGrok continues generating sexualised images despite new safeguards

-

Tech2 days ago

Tech2 days agoOpenAI and Anthropic launch faster, smarter AI tools for enterprise coding

-

Shows4 days ago

Shows4 days agoAI in education: Transforming learning, challenges, and future skills

-

News3 days ago

News3 days agoOil prices surge as U.S.-Iran tensions escalate