Money

Stocks rise as Fed minutes, earnings await release

Stocks near record highs as investors eye Fed minutes and upcoming manufacturing updates amid positive inflation data.

Money

Markets edge higher as 10-year yields hit new highs

Major stock indices rise slightly; 10-year Treasury yield hits 4.23% amid Fed Chair speculation, affecting small and mega-cap stocks.

Money

Commodities surge as oil volatility and metals hit record highs

Oil prices fluctuate due to geopolitical tensions; precious metals soar amid inflation concerns, sparking a commodities rally.

Money

Stocks slide and Trump cancels talks: What’s next for markets and Greenland?

U.S. stocks dip; S&P 500 down 0.9%, as investors react to weak bank earnings and market volatility.

-

Ticker Views4 days ago

Ticker Views4 days agoGlobal power struggles and Arctic shipping risks

-

Leaders4 days ago

Leaders4 days agoSendle’s closure impacts Australia’s small business logistics

-

News5 days ago

News5 days agoIran protests and the global fight for freedom

-

Money5 days ago

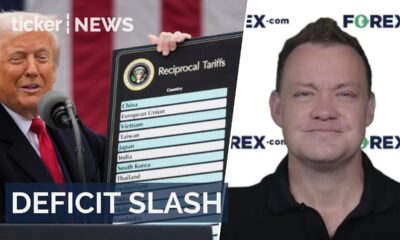

Money5 days agoU.S. budget deficit falls to $1.67 trillion

-

Docos5 days ago

Docos5 days agoTrump threatens to take Greenland as NATO crisis erupts

-

News5 days ago

News5 days agoU.S. moves personnel from Qatar base amid Iran tensions

-

Tech5 days ago

Tech5 days agoX restricts Grok AI as global backlash grows

-

Tech4 days ago

Tech4 days agoTSMC posts record profits on AI chip boom