News

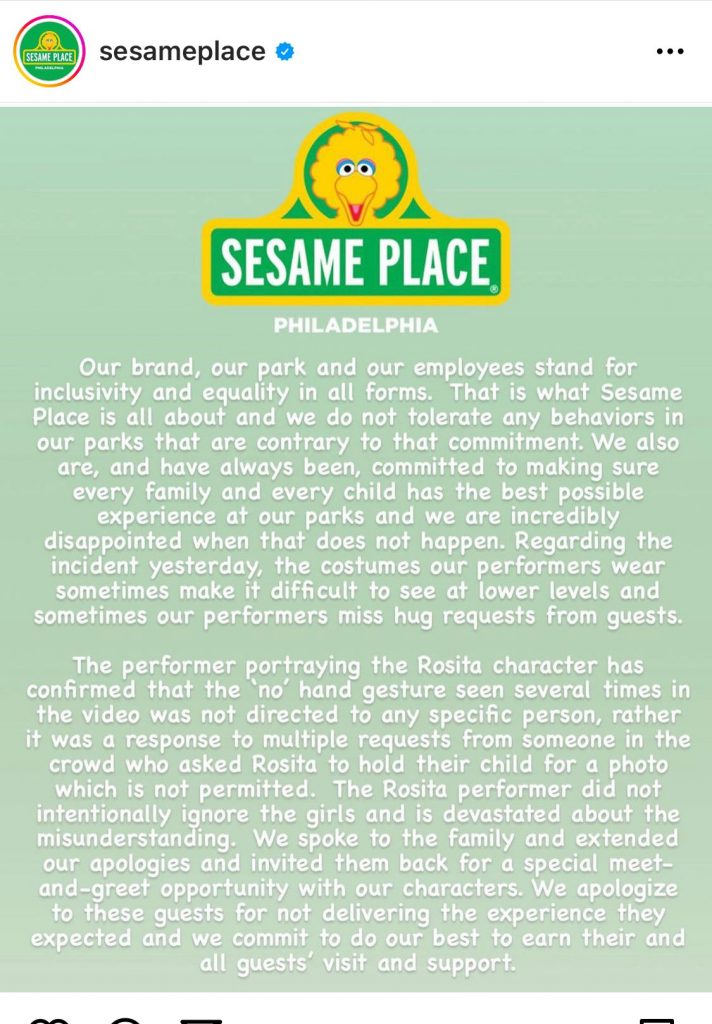

Sesame Place promises more training after backlash

News

U.S. ramps up Cuba aid as energy crisis deepens

News

SpaceX expands Starlink with phone plans and satellite tracking ambitions

SpaceX expands Starlink with a mobile device and space tracking, raising concerns over revenue and US government reliance.

News

Oil prices surge as U.S.-Iran tensions escalate

-

Ticker Views3 days ago

Ticker Views3 days agoElon Musk merges SpaceX and xAI to create solar-powered AI data centres

-

Money4 days ago

Money4 days agoAustralia’s inflation hits 3.8%: Budget decisions under pressure

-

Money5 days ago

Money5 days agoWall Street gains momentum amid tech and earnings surge

-

Ticker Views3 days ago

Ticker Views3 days agoRBA interest rate increase explained – impact on Australians

-

News1 day ago

News1 day agoU.S. ramps up Cuba aid as energy crisis deepens

-

Ticker Views4 days ago

Ticker Views4 days agoUS-Russia nuclear arms control treaty comes to an end

-

News3 days ago

News3 days agoAmazon launches AI tools to change film and television production

-

News4 days ago

News4 days agoGrok continues generating sexualised images despite new safeguards