News

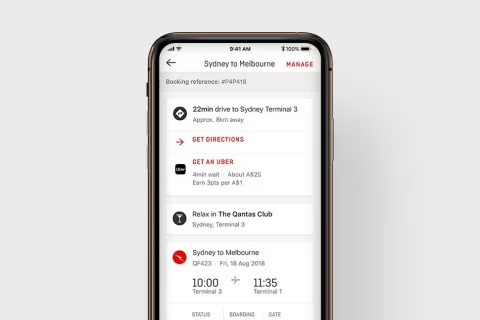

Qantas app privacy breach sparks urgent investigation

News

Iran live updates: Trump claims Khamenei dead as Iran insists he remains in command

News

Israel strikes Tehran anew as conflict escalates and global markets react

Israel strikes Tehran after Khamenei’s death; U.S. warns of prolonged conflict as tensions escalate in the Middle East.

News

U.S. and Israel strike Iran as missiles hit Gulf bases and oil surges

U.S. and Israel launch major military operation against Iran; tensions rise as conflict escalates, impacting global markets.

-

Money4 days ago

Money4 days agoAustralia’s inflation report and Nvidia earnings impact explained

-

Tech3 days ago

Tech3 days agoMeta launches lawsuits over alleged scam advertising operations

-

News2 days ago

News2 days agoCrude oil prices spike amid U.S.-Israel military action

-

News2 days ago

News2 days agoIran warns ships to avoid Strait of Hormuz

-

News2 days ago

News2 days agoU.S. and Israel attack Iran, escalating regional conflict

-

Tech4 days ago

Tech4 days agoNvidia earnings soar as AI drives 75% revenue growth

-

News9 hours ago

News9 hours agoIran live updates: Trump claims Khamenei dead as Iran insists he remains in command

-

News4 days ago

News4 days agoQantas announces 8,500 jobs and frequent flyer changes