Money

New PM Sunak announces new budget date

Money

Markets edge higher as 10-year yields hit new highs

Major stock indices rise slightly; 10-year Treasury yield hits 4.23% amid Fed Chair speculation, affecting small and mega-cap stocks.

Money

Commodities surge as oil volatility and metals hit record highs

Oil prices fluctuate due to geopolitical tensions; precious metals soar amid inflation concerns, sparking a commodities rally.

Money

Stocks slide and Trump cancels talks: What’s next for markets and Greenland?

U.S. stocks dip; S&P 500 down 0.9%, as investors react to weak bank earnings and market volatility.

-

Ticker Views4 days ago

Ticker Views4 days agoGlobal power struggles and Arctic shipping risks

-

Leaders4 days ago

Leaders4 days agoSendle’s closure impacts Australia’s small business logistics

-

News5 days ago

News5 days agoIran protests and the global fight for freedom

-

Docos5 days ago

Docos5 days agoTrump threatens to take Greenland as NATO crisis erupts

-

Money5 days ago

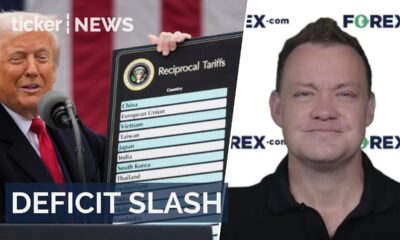

Money5 days agoU.S. budget deficit falls to $1.67 trillion

-

News5 days ago

News5 days agoU.S. moves personnel from Qatar base amid Iran tensions

-

Tech5 days ago

Tech5 days agoX restricts Grok AI as global backlash grows

-

Tech4 days ago

Tech4 days agoTSMC posts record profits on AI chip boom