Money

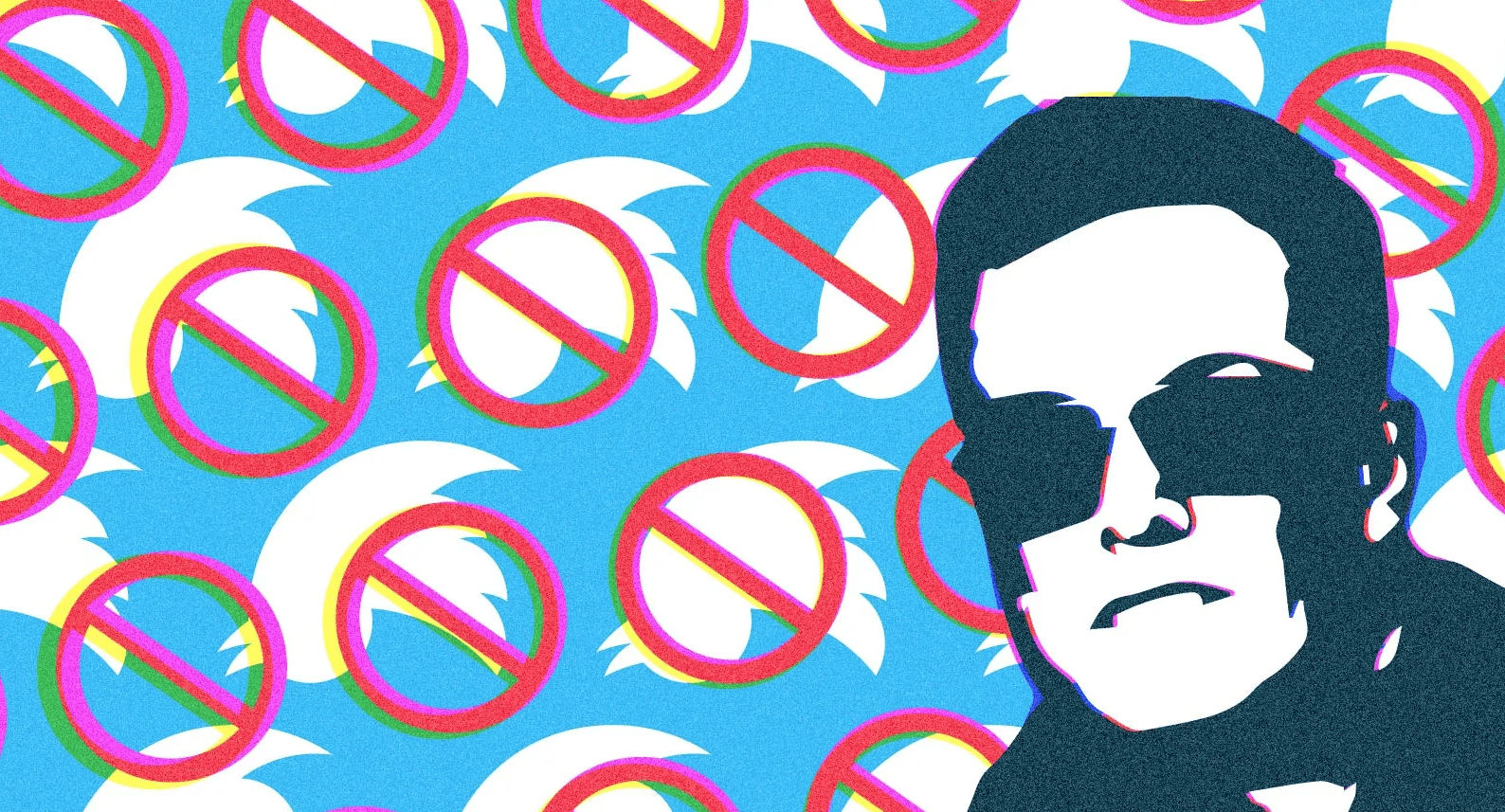

Elon Musk blows up $44b Twitter deal

Money

Stocks rally ahead of Thanksgiving as markets log four days of gains

Markets gain momentum ahead of Thanksgiving, with the Dow up 388 points and Oracle rising 4% amid investor optimism.

Money

Dow surges 500 points amid rate cut optimism

Dow jumps 569 points on fresh hopes for December rate cut and AI market optimism

Money

Gold prices surge as Central Banks buy big, but risks grow ahead

Gold prices surge as central banks increase demand; risks include a stronger dollar and rising interest rates.

-

Shows1 day ago

Shows1 day agoAI and automation driving sustainability in industries

-

Shows1 day ago

Shows1 day agoEarly adopters of automation gain significant competitive advantage

-

Shows1 day ago

Shows1 day agoCybersecurity concerns rise amidst AI industrial adoption

-

Leaders4 days ago

Leaders4 days agoRegional small businesses thrive through digital marketing strategies

-

Shows1 day ago

Shows1 day agoHow London is attracting global investment and staying competitive

-

News1 day ago

News1 day agoRobotics and AI driving fourth industrial revolution innovations

-

News4 days ago

News4 days agoShoppers cut back this Black Friday as budgets tighten

-

News4 days ago

News4 days agoNational Guard ambush: Afghan man charged after D.C. shooting