Money

Australian watchdog investigating shipping cost price-hike

Money

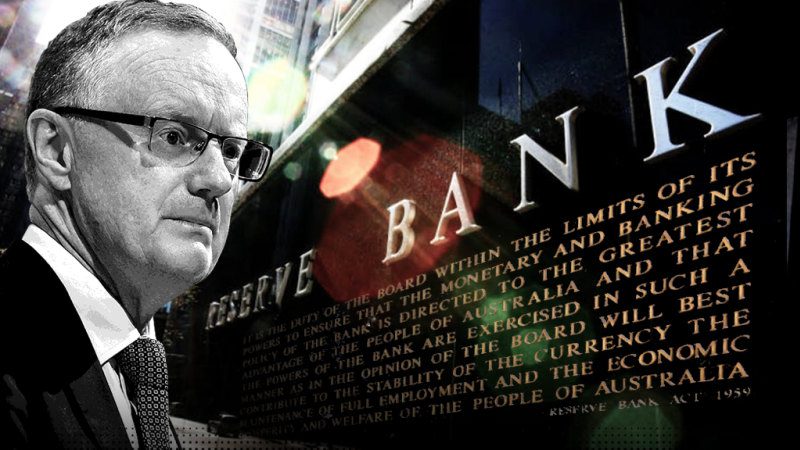

Australia’s inflation report and Nvidia earnings impact explained

Australia’s inflation report sparks market shifts, influencing interest rates, the Aussie dollar, and investor sentiment amid Nvidia’s earnings.

Money

U.S. stocks rally as AMD, Home Depot, and AI software lead gains

U.S. equities rose as AI disruption fears eased, with Home Depot, AMD, and DocuSign driving tech stock gains.

Money

Stocks tumble amid AI concerns and Trump tariff update

Dow drops 800+ points as AI and trade worries hit tech and retail stocks; bonds rise amid market volatility.

-

Tech4 days ago

Tech4 days agoMeta launches lawsuits over alleged scam advertising operations

-

News3 days ago

News3 days agoCrude oil prices spike amid U.S.-Israel military action

-

News3 days ago

News3 days agoIran warns ships to avoid Strait of Hormuz

-

News8 hours ago

News8 hours agoIran live updates: Airlines face disruptions that surpass previous Middle East conflicts

-

News3 days ago

News3 days agoU.S. and Israel attack Iran, escalating regional conflict

-

News3 days ago

News3 days agoMarkets brace for turmoil after U.S. strikes Iran

-

Shows1 day ago

Shows1 day agoCities reshaped by capital, policy, and design insights

-

Shows1 day ago

Shows1 day agoUnderstanding commercial lending’s unique challenges and strategies