Money

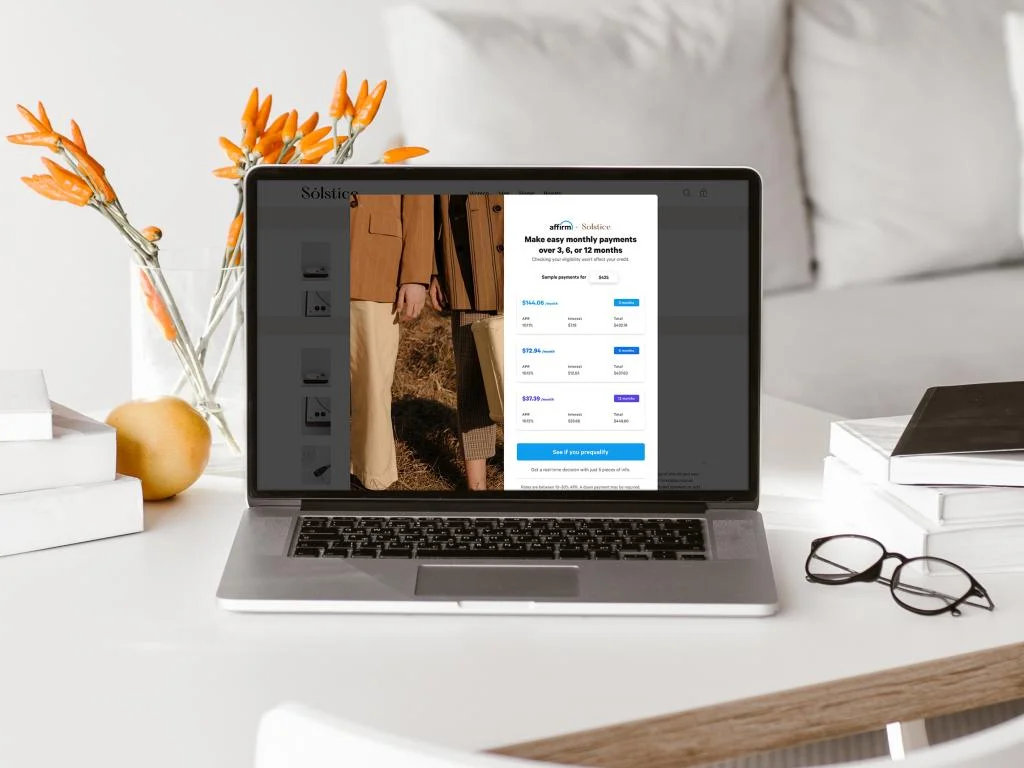

Affirm shareholders see double following Amazon announcement

-

News3 days ago

News3 days agoAI enters the Big Brother house, raising concerns around the truth of reality TV

-

Leaders3 days ago

Leaders3 days agoUN initiative aims to set international standards for AI ethics

-

Shows3 days ago

Shows3 days agoMining and fluid businesses witness growing interest from investors

-

News3 days ago

News3 days agoNo console, no problem according to Amazon’s next-gen streaming innovation

-

Docos5 days ago

Docos5 days agoVP Kamala Harris will officially run against former President Donald Trump in the 2024 U.S. election

-

Leaders4 days ago

Leaders4 days agoHarris secures strong Democratic support for White House run despite challenges

-

Leaders4 days ago

Leaders4 days agoU.S. Secret Service Director admits security failure, faces rising resignation demands

-

News2 days ago

News2 days agoMeidcal breakthrough on ‘fountain of youth’ uncovered by scientists