Money

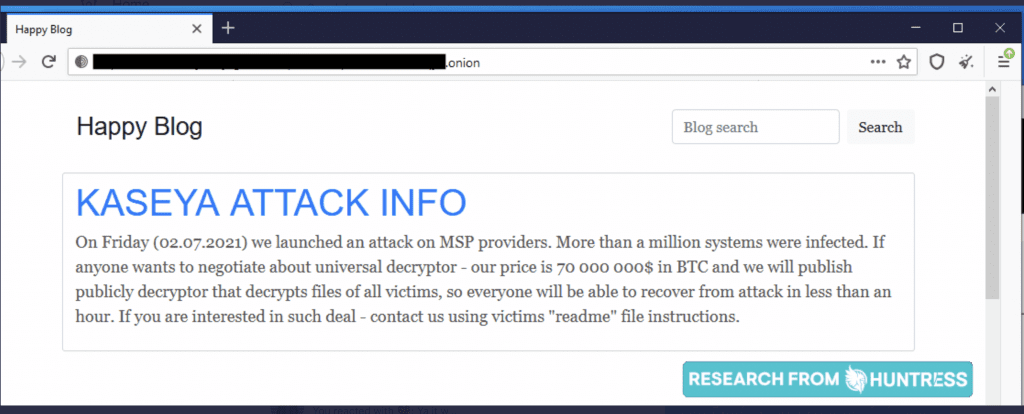

Russian ‘REvil gang’ hackers demands $70M Bitcoin ransom payout

Money

U.S. stocks falling amid AI worries and weak earnings

U.S. stocks decline amid AI concerns, defensive sectors rising; traders eye commodities, jobs data, and currency trends for insights.

Money

Wall Street tumbles as tech stocks face AI disruption fears

Wall Street falters as tech stocks dive amid AI anxieties; 2026 seen as critical for proving AI investment returns.

Money

U.S. jobs report, Fed decisions, and Japan’s economic risks explained

January US jobs report sparks uncertainty; analysts debate impact on Federal Reserve policy and market confidence.

-

Ticker Views3 days ago

Ticker Views3 days agoLunar Gateway faces delays and funding debate amid Artemis ambitions

-

News1 day ago

News1 day agoRussia bans WhatsApp and promotes state-backed messaging app

-

Ticker Views3 days ago

Ticker Views3 days agoSouth Korea introduces AI job protection legislation

-

Ticker Views4 days ago

Ticker Views4 days agoU.S. ambassador responds to NATO criticism at Munich Security Conference

-

News1 day ago

News1 day agoAngus Taylor elected Liberal leader after decisive ballot victory

-

News4 days ago

News4 days agoPM Keir Starmer facing his biggest leadership crisis yet

-

Leaders2 days ago

Leaders2 days agoUAE and Saudi Arabia lead MENA’s gaming economy

-

Money4 days ago

Money4 days agoDow hits record while tech stocks drive market gains