Money

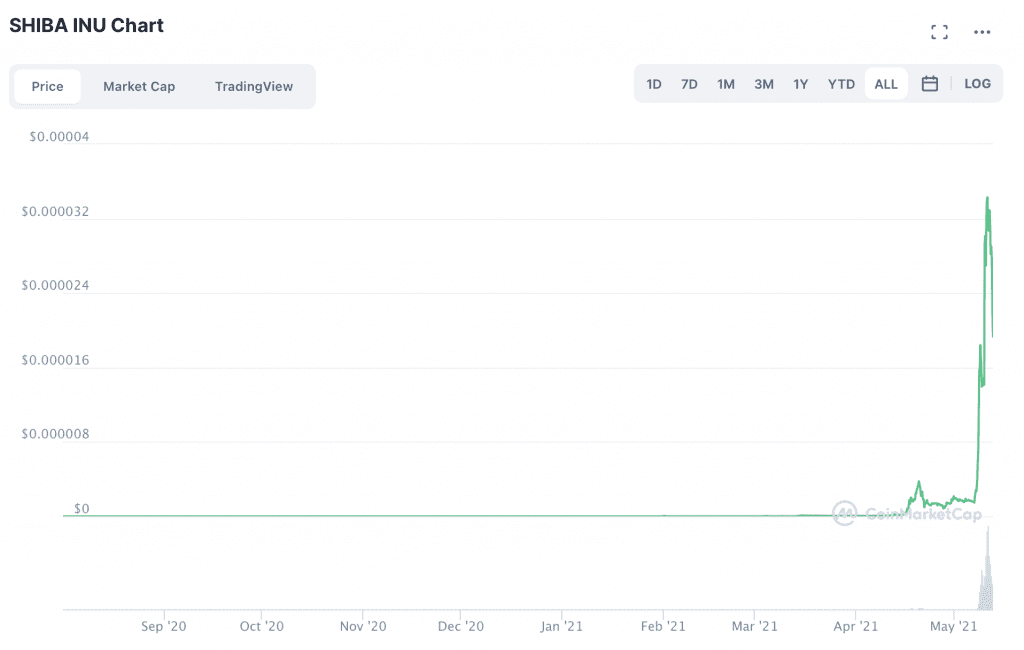

SHIB climbs – Gets major exchange listing with OKEx

Money

Wall Street hits record highs as markets shrug off Venezuela tensions

US markets hit record highs as investors shrug off geopolitical tensions, with the S&P 500 up 0.7% and Dow 1%.

Money

Dow hits record after U.S. military action in Venezuela

Dow Jones surged 600 points post-U.S. action in Venezuela, boosting energy stocks amid cautious gold futures rise.

Money

Wall Street eyes further gains in 2026 as rate cuts fuel optimism

Wall Street enters 2026 optimistic as falling interest rates and strong earnings drive stock market expectations amid economic resilience.

-

Tech4 days ago

Tech4 days agoCES 2026 Highlights: AI, robotics, and the future of innovation

-

Ticker Views2 days ago

Ticker Views2 days agoViruses experts are watching in 2026

-

Crypto3 days ago

Crypto3 days agoMorgan Stanley files for Bitcoin, Solana, and Ethereum ETFs

-

Tech4 days ago

Tech4 days agoCES 2026 opens with AI powering the future of tech

-

Tech3 days ago

Tech3 days agoGlobal memory chip shortage set to drive electronics prices higher

-

Ticker Views5 days ago

Ticker Views5 days agoElon Musk faces backlash over Grok AI Deepfakes

-

News21 hours ago

News21 hours agoTrump declares US ready to support Iranian protesters

-

News4 days ago

News4 days agoPM initiates royal commission on anti-Semitism and unity