China’s top leaders have acknowledged significant challenges in the nation’s economy as its post-Covid recovery faces obstacles.

Of particular concern is the soaring youth unemployment rate, which reached a record 21.3% in June. Some experts believe the actual rate could be much higher, up to 46.5% in March, when factoring in young people not actively seeking work or relying on their families for support.

The severity of the crisis is evident in the emergence of a new phenomenon called “full-time sons and daughters.” Many young Chinese individuals are paid by their families to stay at home, avoiding the intense competition in the job market and embracing a simpler lifestyle. This trend reflects the struggles they face in securing employment opportunities.

Internationally, there is growing anxiety over China’s economic situation.

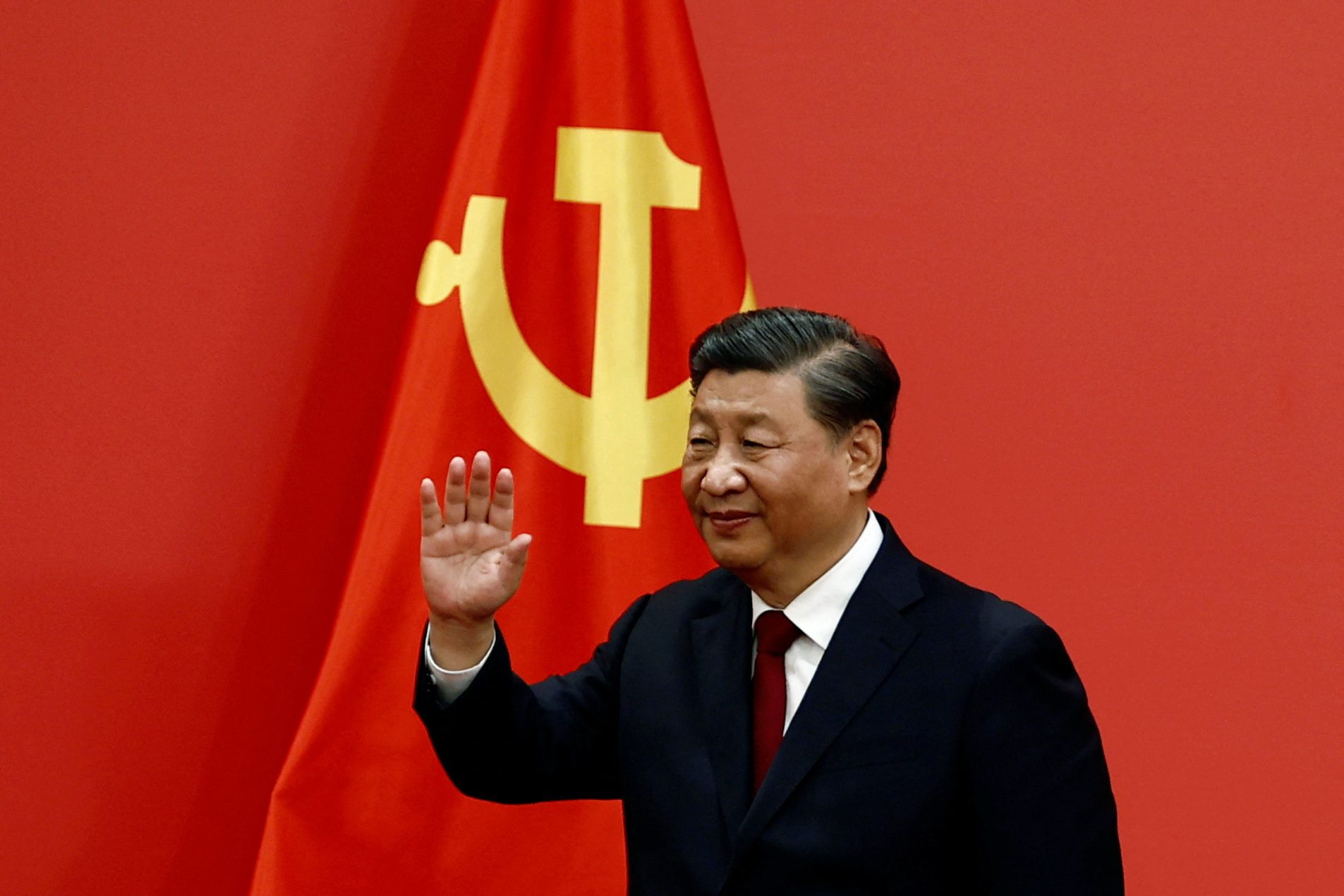

While global inflation appears to be slowing, China’s economy is losing momentum, primarily due to sluggish consumer spending. The 24-person Politburo, the highest-ranking officials in the country, convened a meeting and acknowledged the challenges, including insufficient domestic demand, operational difficulties for businesses, and a complex external environment.

To address the economic downturn, the Politburo called for precise and effective macroeconomic regulation, countercyclical policies, and efforts to bolster domestic consumption. The real estate sector, a crucial driver of the Chinese economy, remains in turmoil, with major developers struggling to complete housing projects, leading to protests and mortgage boycotts.

Economic downturn

Despite the disappointing economic data and calls for support measures, the Chinese government has been cautious in its response. The People’s Bank of China cut interest rates, and some assistance was promised to the troubled property sector, but concrete action has been limited. Observers are keenly watching for the policy tone set by top leaders, hoping for indications of significant stimulus measures.

China aims for about five per cent economic growth this year, one of the lowest targets in decades. Achieving this goal will be challenging, as Premier Li Qiang has warned. While some measures have been introduced to promote the purchase of automobiles and boost consumption in artificial intelligence and electronics sectors, a comprehensive stimulus package is yet to be seen.

In conclusion, China’s economy is grappling with serious issues, including soaring youth unemployment and sluggish growth. The government’s response remains cautious, with observers anxiously awaiting any significant policy shifts. The nation’s economic performance will undoubtedly have implications not only for China but also for the global economy.

News3 days ago

News3 days ago

Leaders3 days ago

Leaders3 days ago

Shows3 days ago

Shows3 days ago

News3 days ago

News3 days ago

Docos5 days ago

Docos5 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago

News2 days ago

News2 days ago