News

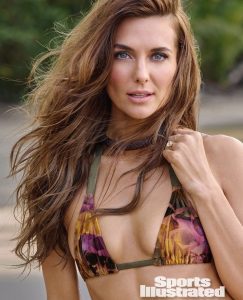

Sports Illustrated Swimsuit announces Melissia Wood-Tepperberg as a 2023 Rookie

News

U.S. and Israel attack Iran, escalating regional conflict

U.S. and Israel strike Iran, escalating war fears and risking wider regional conflict for the second time in eight months

News

Australia issues evacuation advisory for diplomats and citizens in the Middle East

Australian diplomats’ families in Israel and Lebanon urged to evacuate amid rising tensions; all Australians advised to leave soon.

News

Trump signals possible action on Iran nuclear threat

Trump warns Iran on nuclear weapons and highlights threats, as US boosts military presence amid stalled talks.

-

Tech3 days ago

Tech3 days agoOpenAI moves to replace software giants with AI products

-

Money2 days ago

Money2 days agoAustralia’s inflation report and Nvidia earnings impact explained

-

Tech1 day ago

Tech1 day agoMeta launches lawsuits over alleged scam advertising operations

-

Tech4 days ago

Tech4 days agoAnthropic CEO holds key Pentagon talks on AI ethics and military use

-

Money4 days ago

Money4 days agoStocks tumble amid AI concerns and Trump tariff update

-

Tech2 days ago

Tech2 days agoNvidia earnings soar as AI drives 75% revenue growth

-

News2 days ago

News2 days agoQantas announces 8,500 jobs and frequent flyer changes

-

News4 days ago

News4 days agoPeter Mandelson arrested in London over alleged Epstein links