News

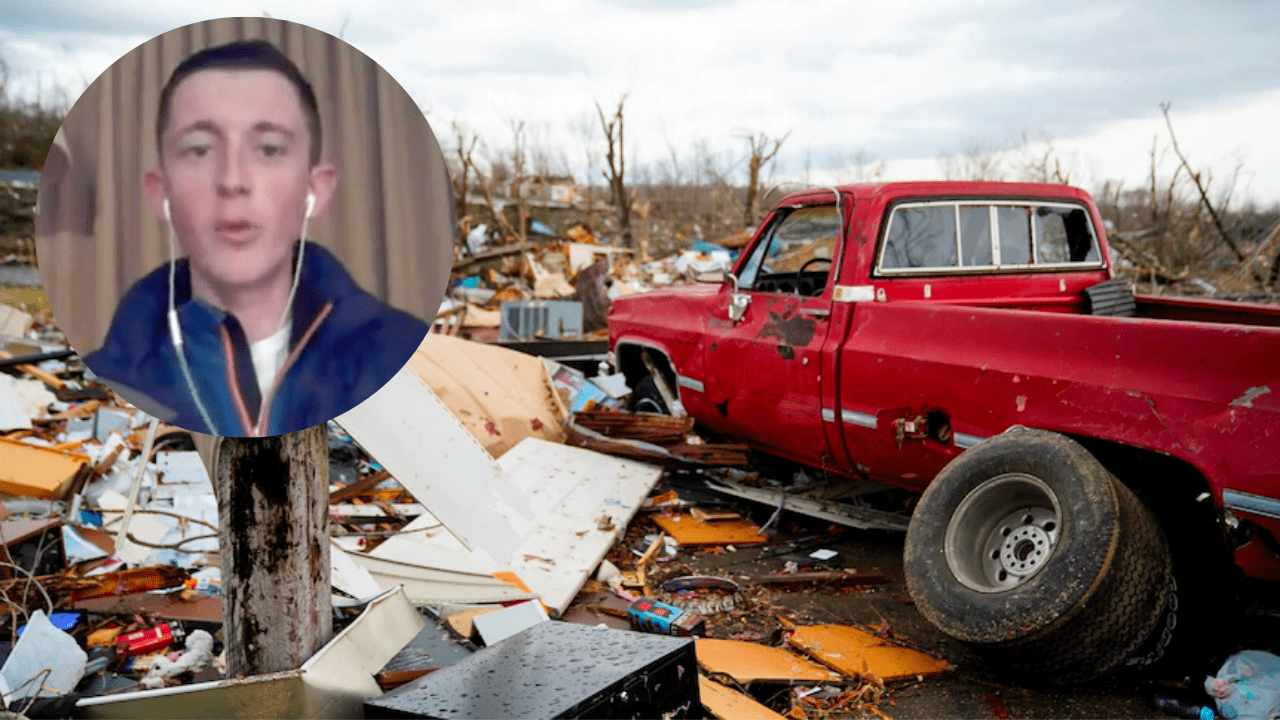

“Like a movie scene” – Reporter on the ground describes Kentucky tornadoes

News

Grok continues generating sexualised images despite new safeguards

Elon Musk’s AI chatbot Grok faces scrutiny for generating non-consensual sexualized images despite new safety restrictions.

News

Peter Mandelson investigated by police over alleged Epstein information leaks

Scotland Yard investigates Lord Mandelson for allegedly leaking information to Epstein; PM Starmer vows to revoke his peerage if guilty.

News

U.S. downs Iranian drone near USS Abraham Lincoln as Gulf tensions rise

U.S. jet downed Iranian drone by USS Abraham Lincoln amid rising tensions; Iranian boats threatened U.S. tanker, risking misjudgment.

-

Ticker Views21 hours ago

Ticker Views21 hours agoElon Musk merges SpaceX and xAI to create solar-powered AI data centres

-

Tech3 days ago

Tech3 days agoNvidia and Amazon explore massive OpenAI funding round

-

Money2 days ago

Money2 days agoAustralia’s inflation hits 3.8%: Budget decisions under pressure

-

Money2 days ago

Money2 days agoWall Street gains momentum amid tech and earnings surge

-

Shows3 days ago

Shows3 days agoHow AI is transforming real estate investment strategies

-

Ticker Views21 hours ago

Ticker Views21 hours agoRBA interest rate increase explained – impact on Australians

-

Ticker Views2 days ago

Ticker Views2 days agoUS-Russia nuclear arms control treaty comes to an end

-

Ticker Views4 days ago

Ticker Views4 days ago3 things to know about Kevin Warsh, Trump’s nod for Fed chair