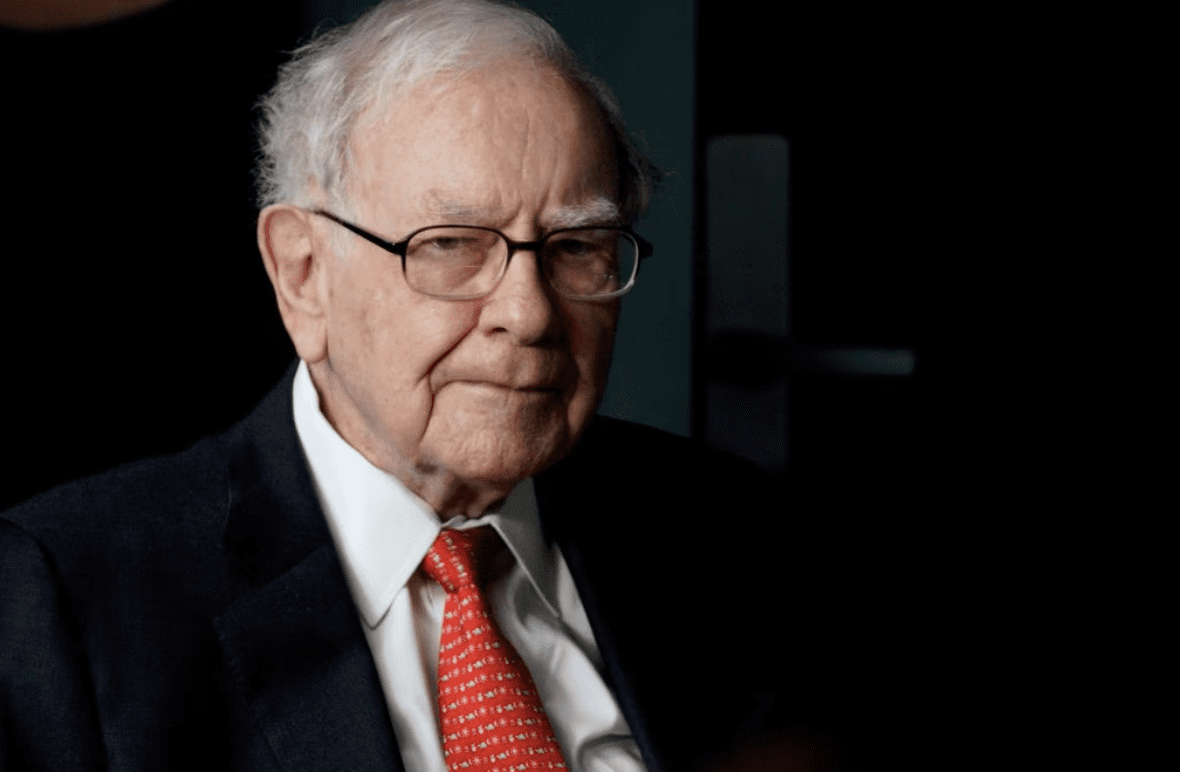

Berkshire Hathaway, led by billionaire Warren Buffett, reported its highest ever quarterly operating profit, driven by gains from stock holdings and the positive performance of its insurance businesses due to rising interest rates.

The conglomerate recorded a nearly $36 billion overall profit.

The insurance businesses at Berkshire saw a 38% increase in profit, benefiting from rising interest rates and improved results at the Geico car insurer. Additionally, interest and other investment income grew sixfold during the second quarter.

However, the same rising rates had adverse effects on other sectors of Berkshire’s business. Higher costs associated with buying and upgrading homes led to negative results at Clayton Homes and building products businesses, as well as reduced demand for RVs from its Forest River unit, resulting in a 34% decrease in revenue.

The BNSF railroad, one of Berkshire’s largest businesses, also experienced a 24% decline in profit, which was attributed to lower shipments of consumer goods, price competition from truckers, and increased employee wages.

Berkshire demonstrated caution towards high stock prices during the quarter, selling $8 billion more in stocks than it bought and repurchasing less of its own stock. The company ended June with a near-record $147.4 billion in cash.

Analysts noted that the impact of higher interest rates on investment income was offsetting the economic softness caused by the same rates. Despite the challenges, Berkshire’s strong earnings reflect the company’s resilience and ability to adapt to changing market conditions.

Economic trends

Investors closely monitor Berkshire’s performance due to Warren Buffett’s reputation and the company’s ability to reflect broader economic trends through its operating units, which encompass various industries and brands.

As the rally in U.S. equities continued, Berkshire remained cautious, indicating that attractive investment opportunities were limited during the period.

Berkshire Hathaway Energy’s overall profit remained relatively stable at $785 million, but the company faces potential losses related to Oregon wildfires in 2020, which could reach $1.02 billion before taxes, with $608 million not covered by insurance.

Despite a strong quarter, some analysts expressed concerns about the company’s organic growth trends and the need for strategic positioning to achieve stronger growth without more frequent acquisitions.

News3 days ago

News3 days ago

News5 days ago

News5 days ago

Leaders3 days ago

Leaders3 days ago

News3 days ago

News3 days ago

Shows3 days ago

Shows3 days ago

Docos5 days ago

Docos5 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago