Money

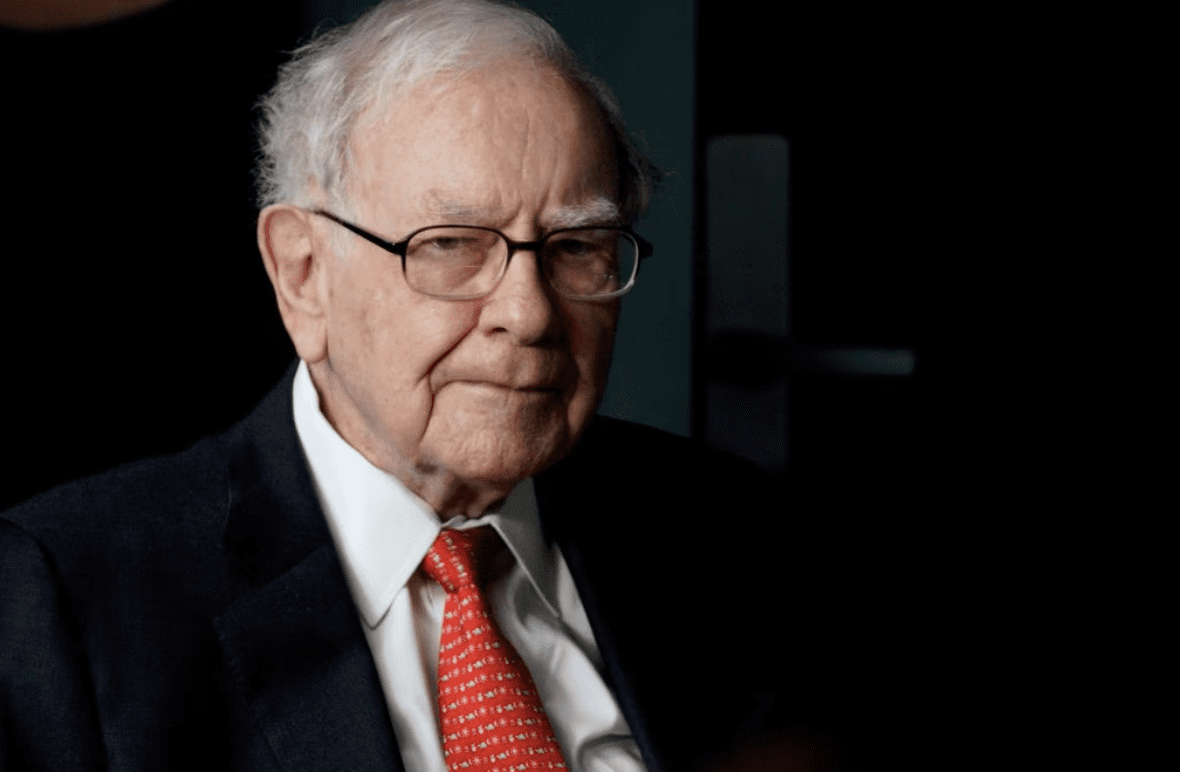

How Warren Buffett’s Berkshire achieves record profits

Money

U.S. investors flee stock market for global opportunities

U.S. investors withdrew $75 billion from stocks in six months, fastest in 16 years, with $52 billion in 2026 alone.

Money

US dollar strength hits NZ dollar amid FX market shifts

US dollar rises amid strong US growth; New Zealand faces pressure as traders navigate volatile FX and geopolitical impacts.

Money

Oil hits seven-month high, and gold surpasses $5,000 amid US-Iran tensions

Oil prices hit seven-month high amid U.S.-Iran tensions; experts analyze impacts on global economy and energy markets.

-

Tech3 days ago

Tech3 days agoSam Altman predicts superintelligence could appear by 2028

-

News4 days ago

News4 days agoAndrew Mountbatten-Windsor released after 12-hour questioning

-

News4 days ago

News4 days agoUkraine Russia peace talks stall with no breakthrough

-

Money3 days ago

Money3 days agoOil hits seven-month high, and gold surpasses $5,000 amid US-Iran tensions

-

Tech4 days ago

Tech4 days agoZuckerberg testifies on social media addiction and child safety

-

Ticker Views4 days ago

Ticker Views4 days agoPrince Andrew arrested: What it means for the Royal Family

-

News3 days ago

News3 days agoBill Gates withdraws from India AI Impact Summit before keynote

-

Money4 days ago

Money4 days agoAustralia jobs, market trends, and tariff ruling: What investors need to know