Borrow, earn, spend and invest worldwide from a single unified account…

Whenever you think of investing, your mind tends to go to only one asset class – the stock market.

Investors don’t think about the many other options that are available to them. And if they do, it gets coupled with the need to open a different account that specialises in that asset class.

For instance, you don’t want to have one broker that can only handle your stock market trading needs, such as Charles Schwab.

And conversely, you don’t want to just have an account, such as Binance or CoinBase, to handle your cryptocurrency requirements. Or, be with Vanguard so you can drip-feed capital into your preferred exchange-traded funds (ETFs).

But what if there was a financial management solution that integrated the ability to buy and sell stocks, options, ETFs, contract for differences (CFDs), bonds, currencies, futures and many others all from a single unified platform?

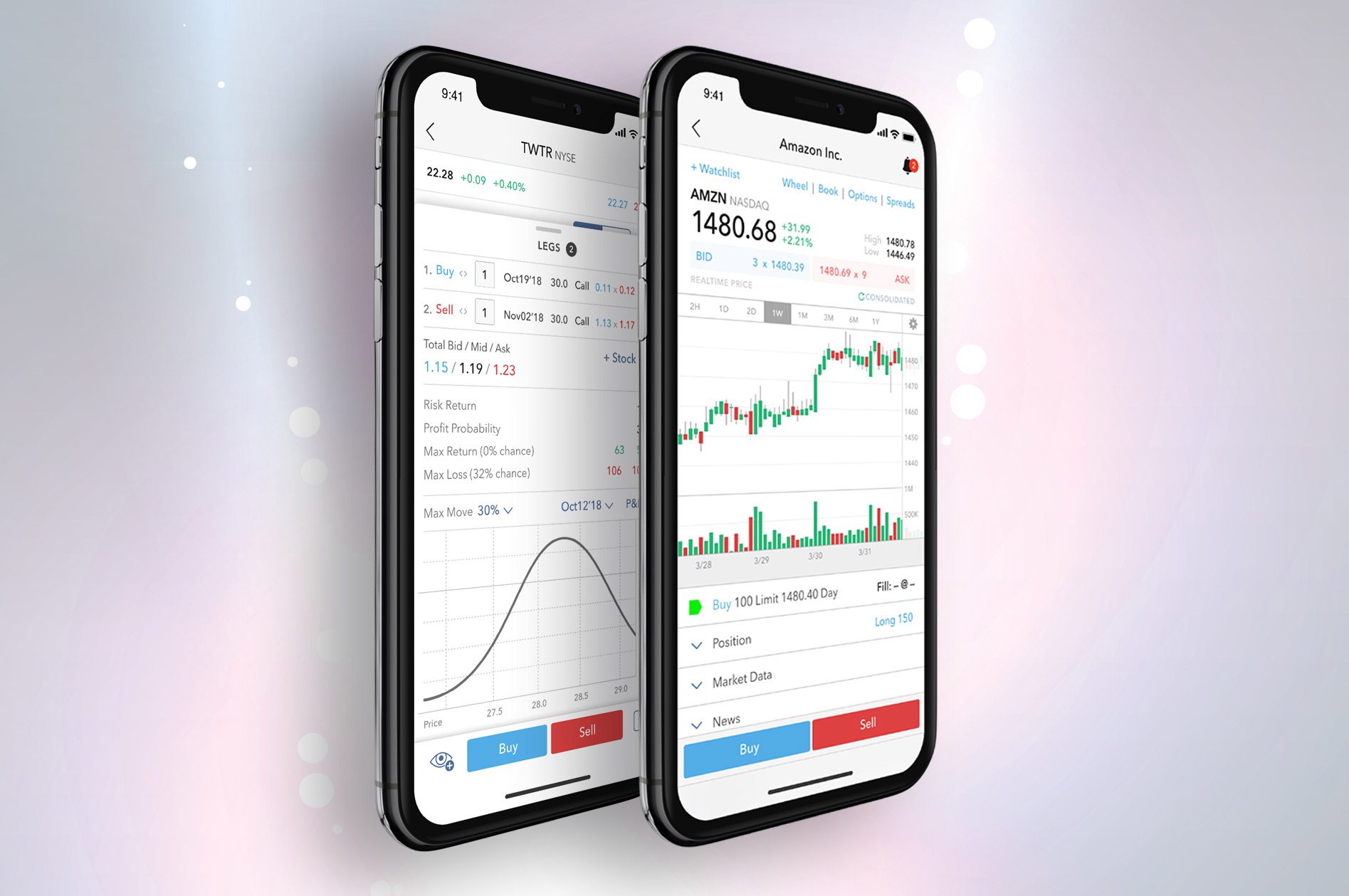

Interactive Brokers (IBKR) is a direct market access platform that is designed to remove any unnecessary intermediaries and third parties between the clients and the markets.

The platform offers full-service execution, clearing and custody.

With access to 33 countries and 24 currencies, IBKR clients can invest globally in stocks, options, futures, currencies, bonds and funds from one place – the ‘Universal’ Account – allowing an investor to easily manage multiple accounts from a single interface.

The stress and anxiety of not needing to think if the right password has been used, or flicking between apps and website to track how certain products are rising or falling, can help an investor to focus on what really matters.

IBKR also offers the lowest commissions and financial rates, helping investors to minimise costs in order to maximise your returns, and access market data 24 hours a day, six days a week.

Being able to obtain a clear picture of the total portfolio at the click of a button is vital in helping investors manage their risk and exposure.

Investors are able to sign up with Interactive Brokers for a free trial with no commitment. For more information, head to their website.

News3 days ago

News3 days ago

Leaders3 days ago

Leaders3 days ago

Shows3 days ago

Shows3 days ago

News3 days ago

News3 days ago

Docos5 days ago

Docos5 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago

News2 days ago

News2 days ago