News

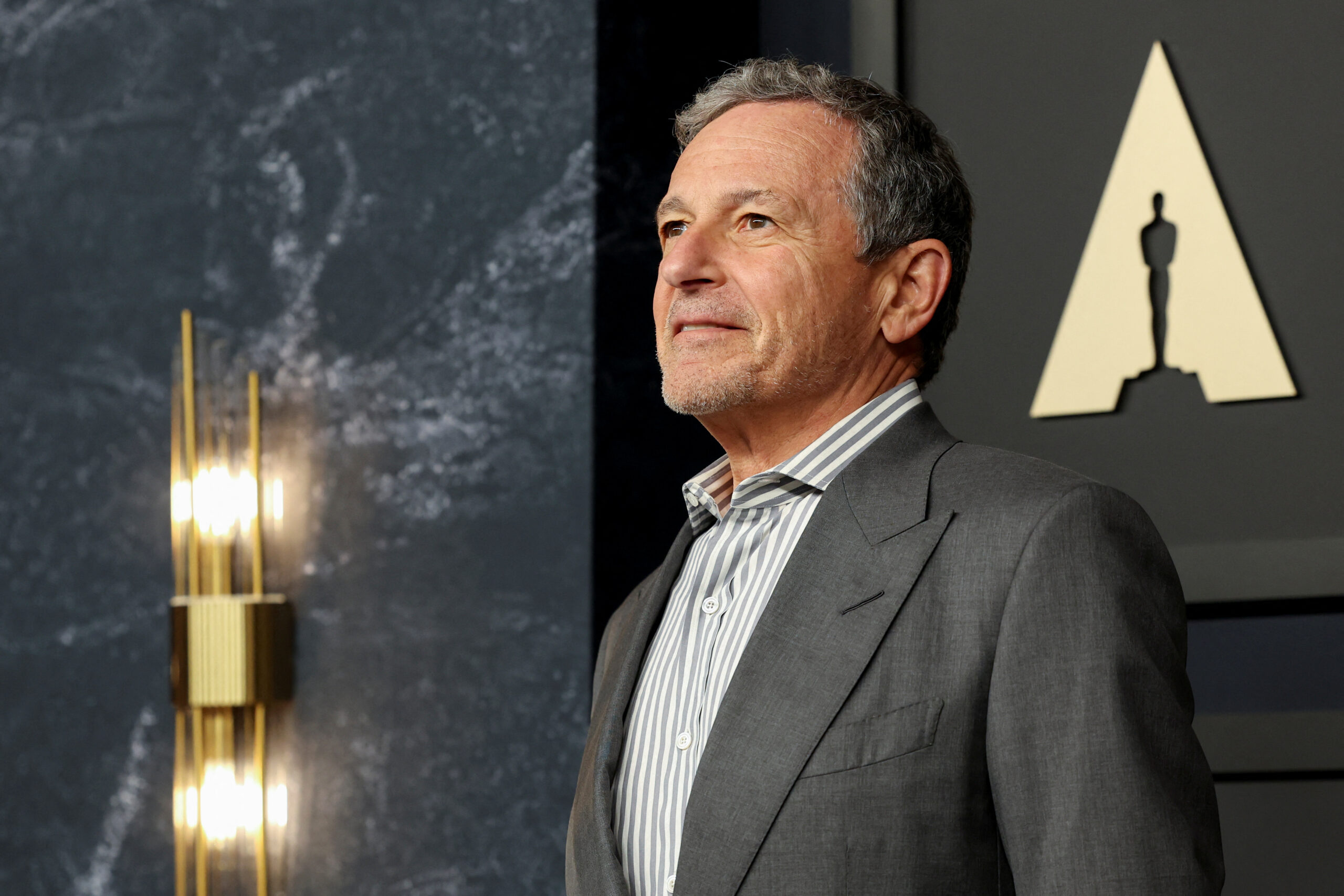

Elon Musk offers to help finance lawsuits against Disney

News

Trump declares US ready to support Iranian protesters

Trump pledges US support for Iranian protesters as regime arrests 100 amid escalating crackdown on dissent

News

Minneapolis protests erupt after fatal ICE shooting

Tensions rise in Minneapolis after fatal shooting by ICE agent, sparking protests and unrest as investigations unfold.

News

Iran protests escalate as economy crumbles

Iran faces widespread protests as currency collapse and soaring inflation strain household budgets, fueling public anger.

-

Tech4 days ago

Tech4 days agoCES 2026 Highlights: AI, robotics, and the future of innovation

-

Crypto3 days ago

Crypto3 days agoMorgan Stanley files for Bitcoin, Solana, and Ethereum ETFs

-

Tech4 days ago

Tech4 days agoCES 2026 opens with AI powering the future of tech

-

Ticker Views2 days ago

Ticker Views2 days agoViruses experts are watching in 2026

-

Tech3 days ago

Tech3 days agoGlobal memory chip shortage set to drive electronics prices higher

-

Ticker Views5 days ago

Ticker Views5 days agoElon Musk faces backlash over Grok AI Deepfakes

-

Ticker Views5 days ago

Ticker Views5 days agoVenezuela, Gaza, Ukraine: is the UN failing?

-

News3 days ago

News3 days agoPM initiates royal commission on anti-Semitism and unity