Money

Experts warn new Australian tax laws could lead to ‘great theft’

Experts Warn New Australian Tax Laws Could Lead to ‘Great Theft’ and Alter Superannuation Perceptions Amid Unrealised Gains Taxation.

Money

Markets edge higher as 10-year yields hit new highs

Major stock indices rise slightly; 10-year Treasury yield hits 4.23% amid Fed Chair speculation, affecting small and mega-cap stocks.

Money

Commodities surge as oil volatility and metals hit record highs

Oil prices fluctuate due to geopolitical tensions; precious metals soar amid inflation concerns, sparking a commodities rally.

Money

Stocks slide and Trump cancels talks: What’s next for markets and Greenland?

U.S. stocks dip; S&P 500 down 0.9%, as investors react to weak bank earnings and market volatility.

-

Ticker Views3 days ago

Ticker Views3 days agoGlobal power struggles and Arctic shipping risks

-

Leaders3 days ago

Leaders3 days agoSendle’s closure impacts Australia’s small business logistics

-

News4 days ago

News4 days agoIran protests and the global fight for freedom

-

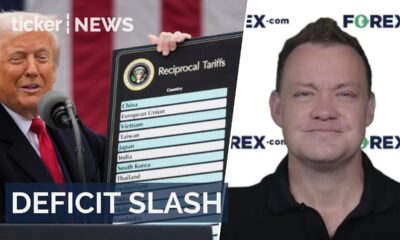

Money4 days ago

Money4 days agoU.S. budget deficit falls to $1.67 trillion

-

Docos4 days ago

Docos4 days agoTrump threatens to take Greenland as NATO crisis erupts

-

News4 days ago

News4 days agoU.S. moves personnel from Qatar base amid Iran tensions

-

Tech4 days ago

Tech4 days agoX restricts Grok AI as global backlash grows

-

Tech3 days ago

Tech3 days agoTSMC posts record profits on AI chip boom