Tech

Does Boeing have a safety problem?

Tech

OpenAI Unveils ChatGPT Atlas: The Future of Browsing?

Tech

OpenAI limits deepfakes after Bryan Cranston’s concerns

OpenAI protects against deepfakes on Sora 2 after Bryan Cranston and SAG-AFTRA raise concerns over unauthorized AI-generated content

Tech

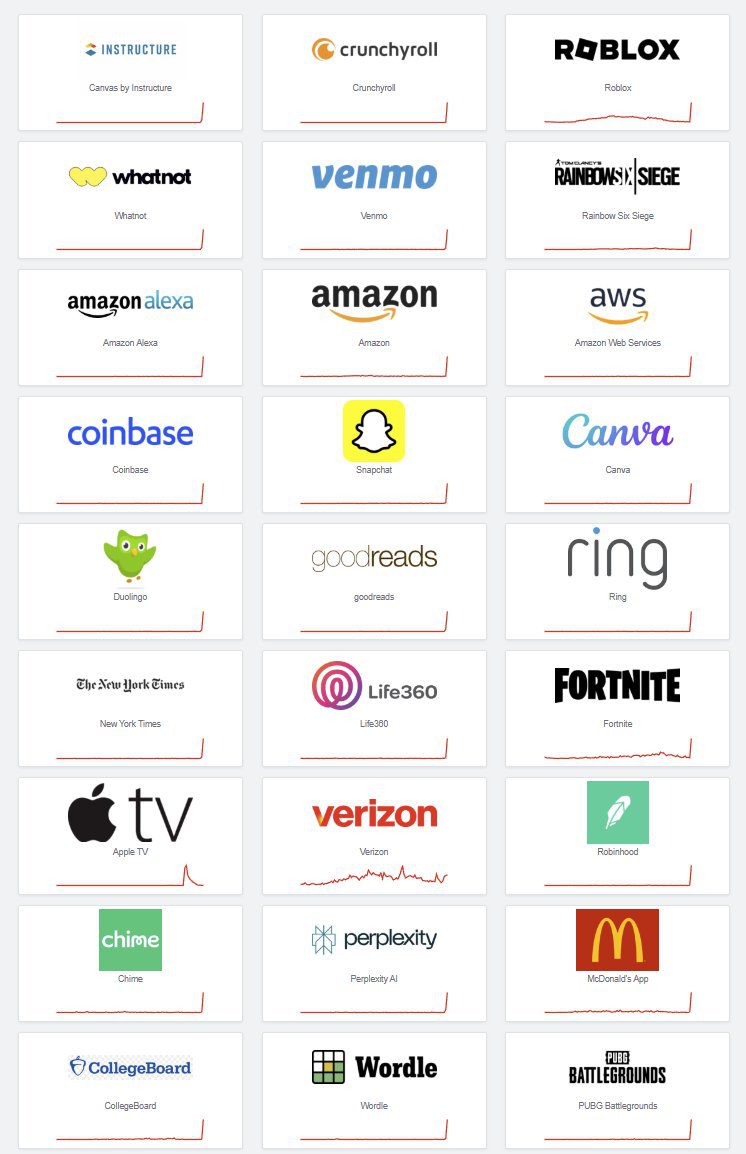

Major apps down as AWS experiences global outage

AWS outage disrupts Fortnite, Snapchat and multiple services globally

-

News18 hours ago

News18 hours agoMarkets cautious as rate cut hopes fade

-

News18 hours ago

News18 hours agoUS–China trade talks are a handshake, not a deal

-

News5 days ago

News5 days agoBitcoin tops $110K as South Korea reforms crypto rules

-

News3 days ago

News3 days agoOil prices drop amid OPEC+ output increase plans

-

Shows5 days ago

Shows5 days agoImprovement districts transforming cities: lessons from London

-

Ticker Views5 days ago

Ticker Views5 days agoWere you on Facebook 10 years ago? You may be able to claim part of this $50 million payout

-

News4 days ago

News4 days agoRussia test-launches nuclear-powered Burevestnik cruise missile

-

News3 days ago

News3 days agoMeta and Amazon signal ‘AI efficiency era’