News

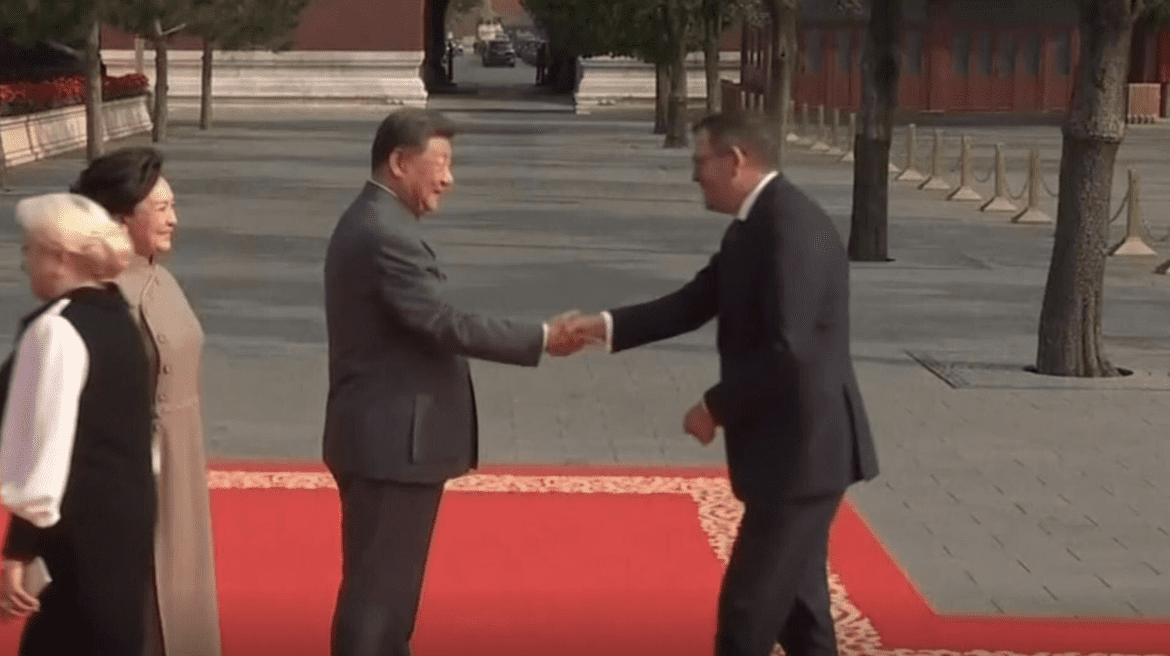

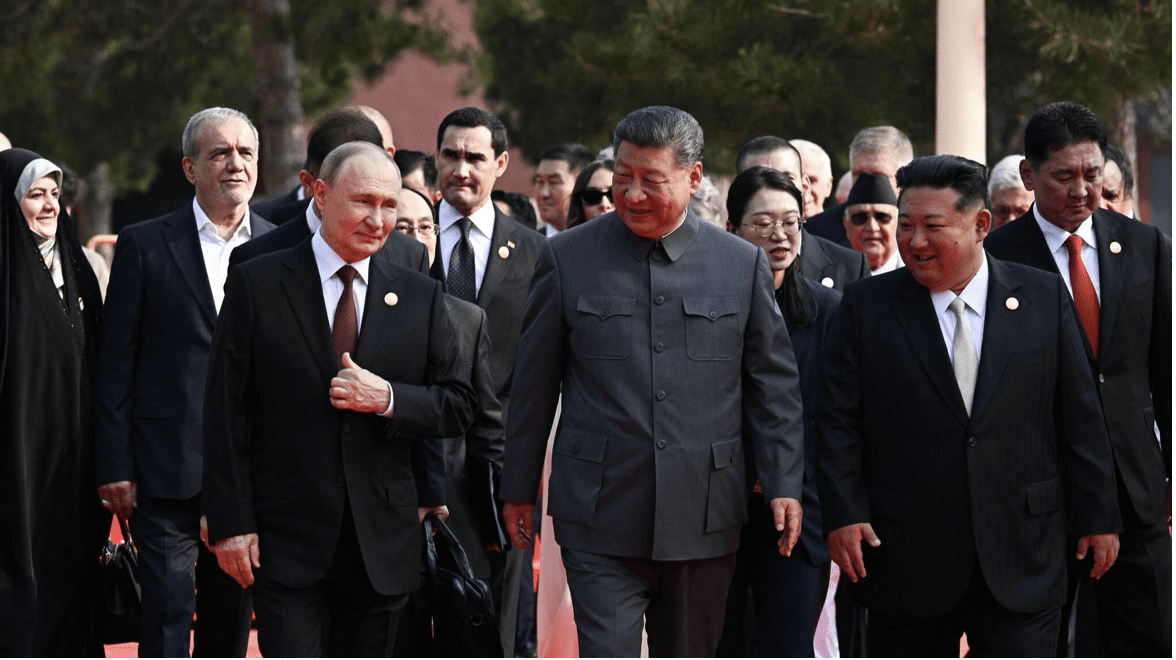

Daniel Andrews joins world dictators at China’s military parade

Andrews joins world leaders at China’s military parade commemorating WWII victory while Xi declares China’s unstoppable rise

-

Ticker Views5 days ago

Ticker Views5 days agoElon Musk merges SpaceX and xAI to create solar-powered AI data centres

-

Ticker Views5 days ago

Ticker Views5 days agoRBA interest rate increase explained – impact on Australians

-

News2 days ago

News2 days agoU.S. ramps up Cuba aid as energy crisis deepens

-

News4 days ago

News4 days agoAmazon launches AI tools to change film and television production

-

News5 days ago

News5 days agoGrok continues generating sexualised images despite new safeguards

-

Tech3 days ago

Tech3 days agoOpenAI and Anthropic launch faster, smarter AI tools for enterprise coding

-

Shows4 days ago

Shows4 days agoAI in education: Transforming learning, challenges, and future skills

-

News3 days ago

News3 days agoOil prices surge as U.S.-Iran tensions escalate