In recent times, China’s economic health has become a topic of international concern. Often regarded as the world’s second-largest economy and home to over 1.4 billion people,

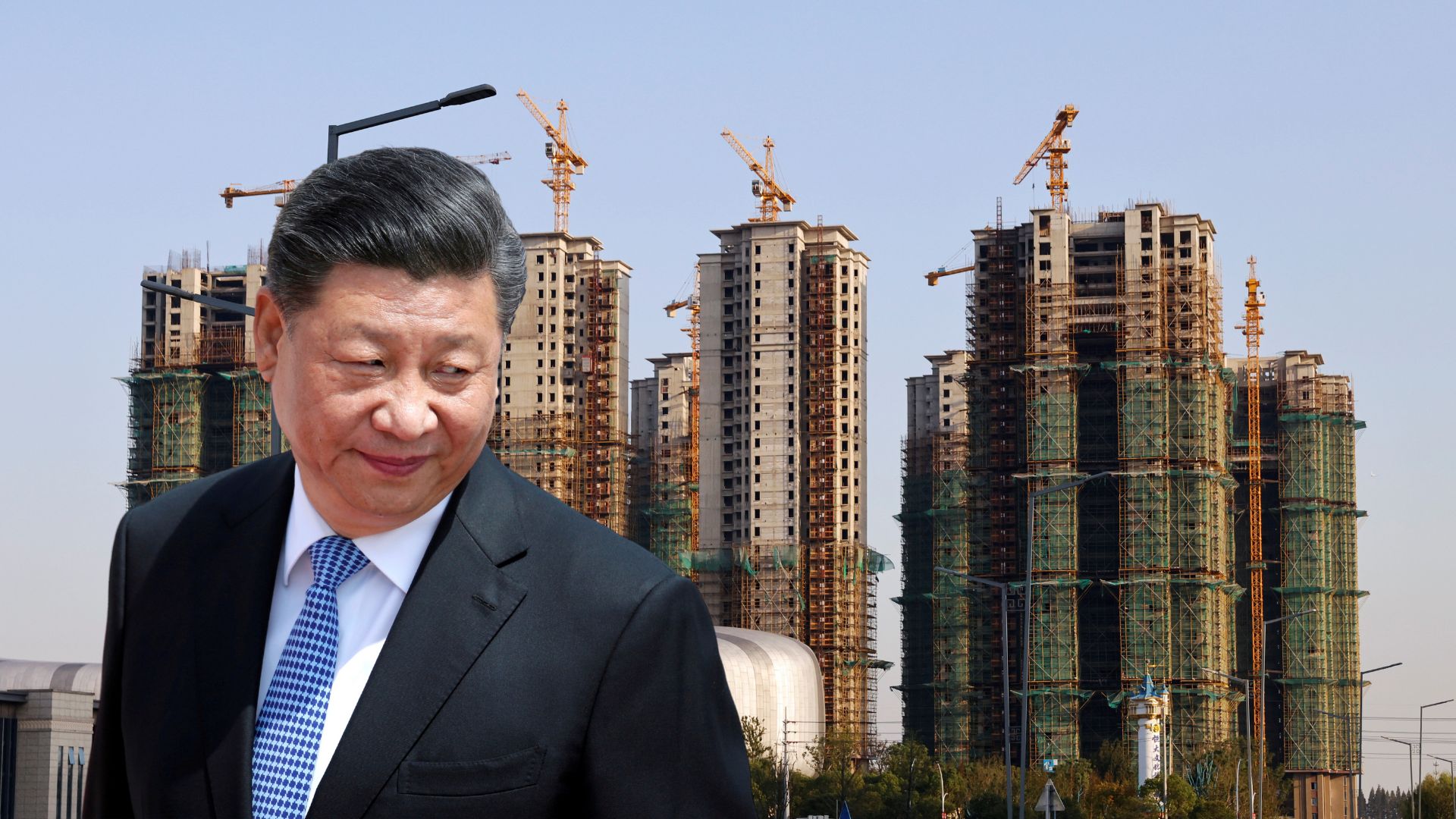

China is grappling with a slew of issues: sluggish growth, soaring youth unemployment, and a turbulent property market. The situation escalated further when the chairman of Evergrande, a heavily-indebted real estate giant, came under police scrutiny, leading to a suspension of the company’s shares on the stock market.

The question on many minds is how much these troubles in China matter to the rest of the world. While some argue that fears of a global catastrophe are exaggerated, there will undoubtedly be repercussions felt by multinational corporations, their employees, and even individuals with no direct ties to China.

China plays a pivotal role in the global economy, responsible for more than a third of worldwide economic growth. Hence, any slowdown in China’s economic engine will reverberate beyond its borders. Multinational giants like Apple, Volkswagen, and Burberry rely heavily on China’s vast consumer market, and reduced domestic consumption in China will affect these companies and, subsequently, their global suppliers and workers.

However, the idea that China is the sole driver of global prosperity has its skeptics. While China’s economic growth contributes significantly to global figures, it primarily benefits China itself due to its trade surplus. This surplus means that China exports far more than it imports, making its growth more self-contained.

Nonetheless, a China that spends less on goods and services, or on housing construction, translates to reduced demand for raw materials and commodities. This hits countries like Australia, Brazil, and African nations, which heavily depend on exporting such resources. Moreover, weak demand in China results in stable prices, which can be welcomed by Western consumers grappling with inflation.

Over the past decade, China has poured over a trillion dollars into expansive infrastructure initiatives like the Belt and Road Initiative, benefiting more than 150 countries. However, if China’s economic problems persist, its capacity to finance such projects abroad may diminish. This could have lasting consequences, especially for developing nations reliant on Chinese investments and technology for their infrastructure development.

News3 days ago

News3 days ago

News5 days ago

News5 days ago

Leaders3 days ago

Leaders3 days ago

Shows3 days ago

Shows3 days ago

News3 days ago

News3 days ago

Docos5 days ago

Docos5 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago

Leaders4 days ago