Money

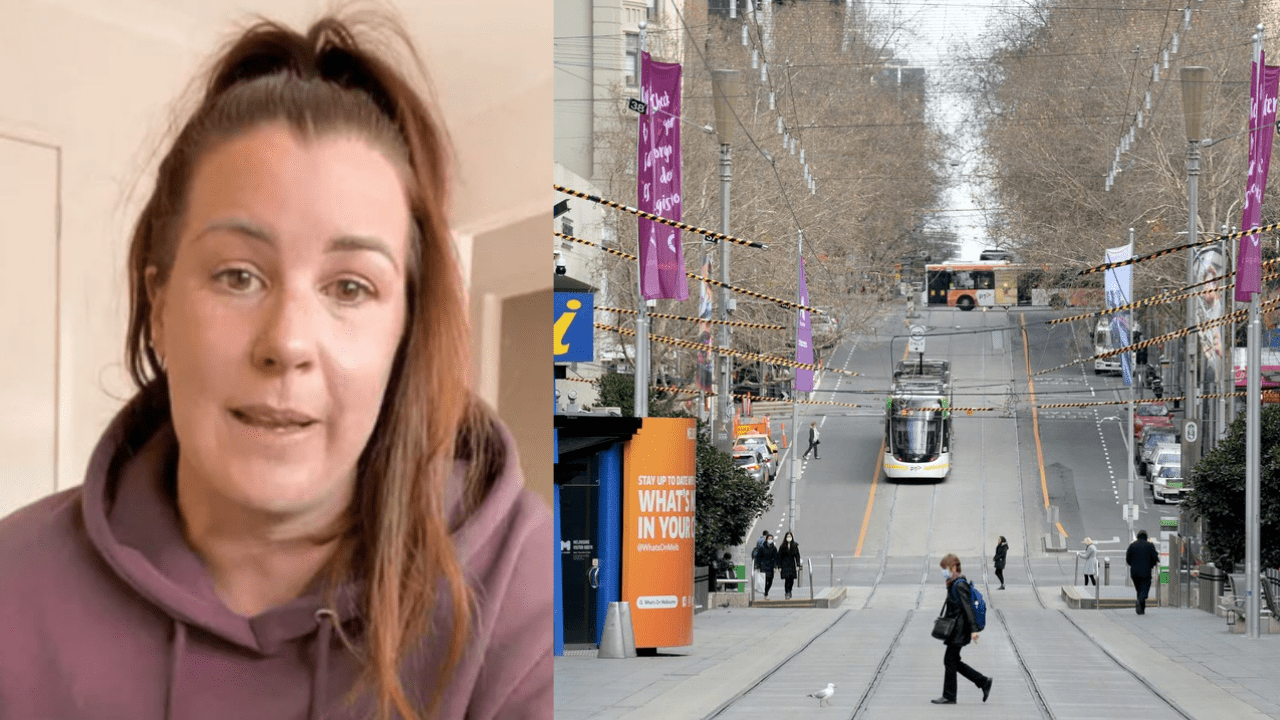

“Can’t eradicate this virus” – Melbourne photographer in viral video pleads for lockdowns to end

Money

U.S. dollar weakens while Australian dollar rises amid global market shifts

Money

Wall Street slides as AI spending raises investor concerns

Wall Street dips as AI spending scrutiny rises; Microsoft struggles while Meta thrives. Tune in for insights!

Money

Tesla brand value plummets amid Elon Musk’s political focus

Tesla’s brand value plummeted to $27.61 billion in 2025 amid Musk’s political shift, sparking investor concern.

-

Tech4 days ago

Tech4 days agoXiaomi reveals fully automated smartphone factory in China

-

News4 days ago

News4 days agoABC News Facebook hacked, porn star images posted

-

News3 days ago

News3 days agoU.S. Naval Strike Group moves into Middle East as Iran protests escalate

-

Crypto4 days ago

Crypto4 days agoBitcoin and Ethereum lead $1.7 billion Crypto market outflow

-

News4 days ago

News4 days agoMark Rutte rejects calls for a separate European army

-

News4 days ago

News4 days agoArrest made following heated speech at Sydney rally

-

News4 days ago

News4 days agoWhite House responds after second fatal shooting in Minneapolis

-

Money3 days ago

Money3 days agoTesla brand value plummets amid Elon Musk’s political focus