Tech

Supply issues cost Apple $6 billion but customers don’t care

Tech

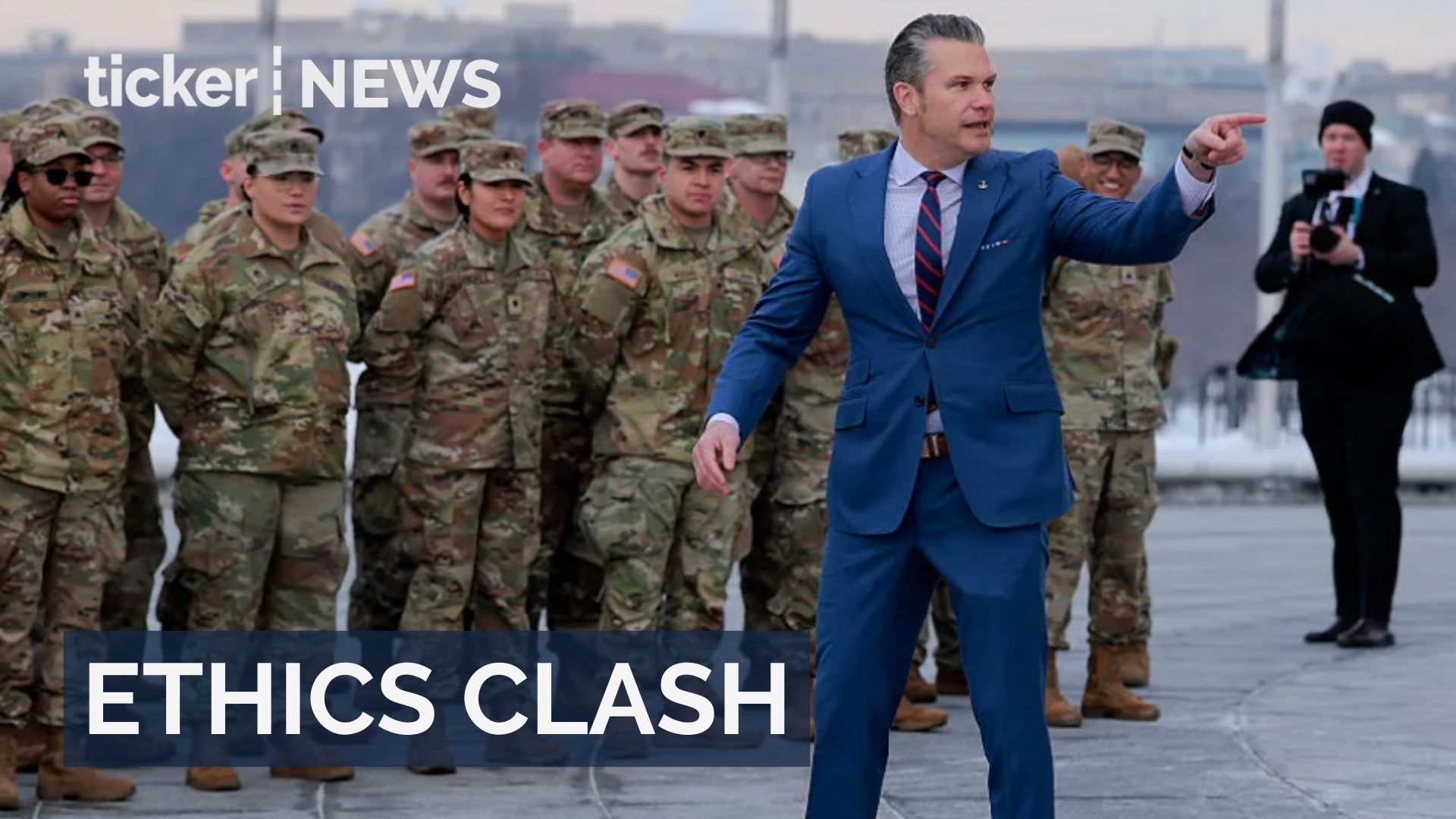

Anthropic CEO holds key Pentagon talks on AI ethics and military use

Anthropic CEO to meet Defense Secretary Hegseth on ethical AI deployment and DOD contract discussions.

Tech

Apple’s next AI wearables could change how we use tech

Apple is launching smart glasses, an AI pendant, and camera-equipped AirPods with upgraded Siri by 2027.

Tech

Sam Altman predicts superintelligence could appear by 2028

Sam Altman warns superintelligence may arise by 2028, advocating for global cooperation and a new governing body for AI.

-

Tech5 days ago

Tech5 days agoSam Altman predicts superintelligence could appear by 2028

-

News5 days ago

News5 days agoAndrew Mountbatten-Windsor released after 12-hour questioning

-

Money4 days ago

Money4 days agoOil hits seven-month high, and gold surpasses $5,000 amid US-Iran tensions

-

Ticker Views5 days ago

Ticker Views5 days agoPrince Andrew arrested: What it means for the Royal Family

-

News5 days ago

News5 days agoBill Gates withdraws from India AI Impact Summit before keynote

-

Leaders4 days ago

Leaders4 days agoYoung author Maya Ahmed publishes debut novel at 13

-

News2 days ago

News2 days agoIran signals nuclear concessions as U.S. talks intensify

-

Money4 days ago

Money4 days agoUS dollar strength hits NZ dollar amid FX market shifts