Money

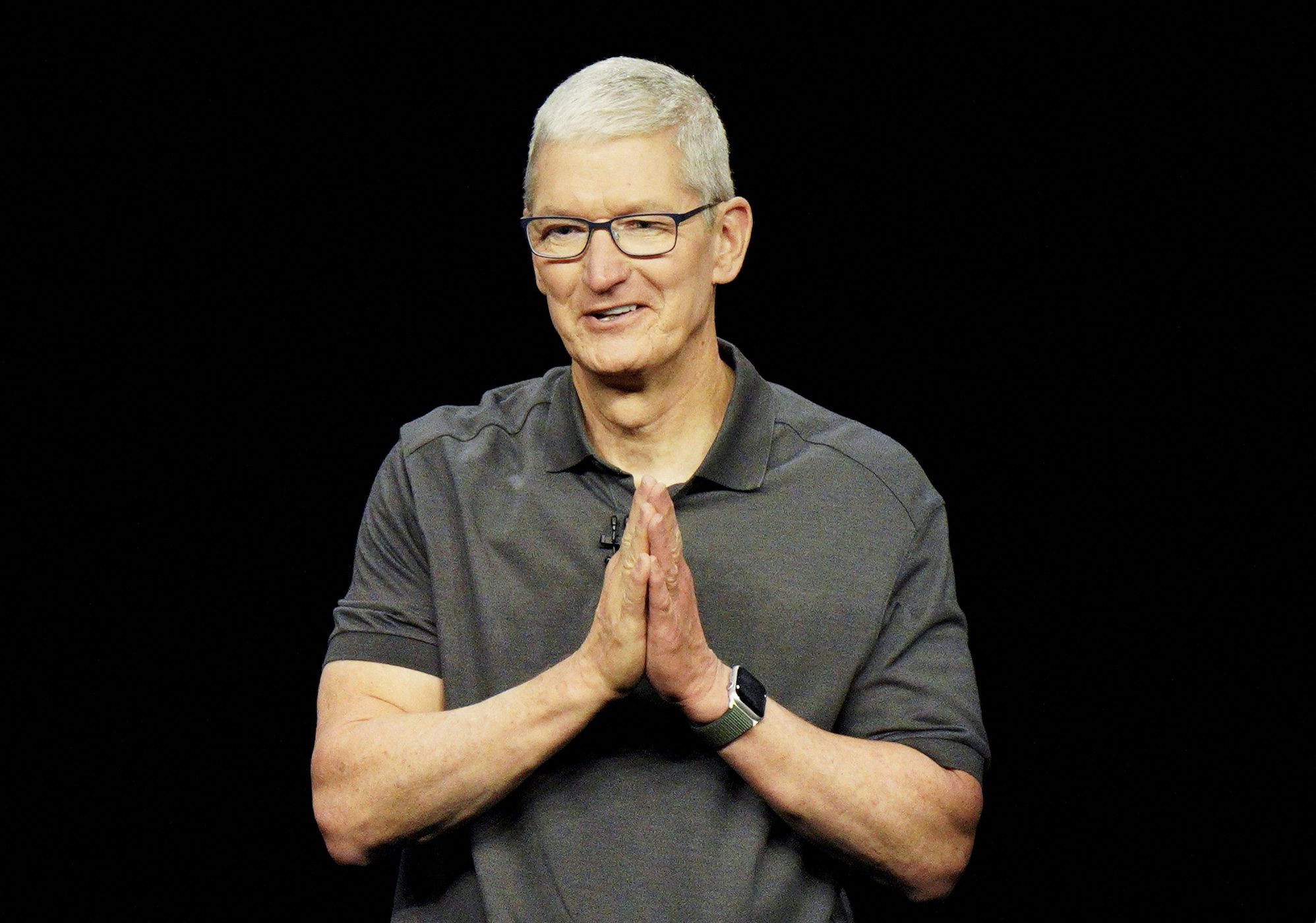

Apple approaches $4 trillion valuation with AI advancements

Apple nearing $4 trillion valuation amid AI advancements, boosting iPhone sales; shares up 16% since November, outpacing Nvidia, Microsoft.

Money

AI fears rattle global markets and investors

AI developments cause market volatility, with European software and US tech firms facing significant declines amid rising uncertainty.

Money

U.S. stocks falling amid AI worries and weak earnings

U.S. stocks decline amid AI concerns, defensive sectors rising; traders eye commodities, jobs data, and currency trends for insights.

Money

Wall Street tumbles as tech stocks face AI disruption fears

Wall Street falters as tech stocks dive amid AI anxieties; 2026 seen as critical for proving AI investment returns.

-

Ticker Views5 days ago

Ticker Views5 days agoLunar Gateway faces delays and funding debate amid Artemis ambitions

-

Leaders4 days ago

Leaders4 days agoUAE and Saudi Arabia lead MENA’s gaming economy

-

News3 days ago

News3 days agoRussia bans WhatsApp and promotes state-backed messaging app

-

News3 days ago

News3 days agoAngus Taylor elected Liberal leader after decisive ballot victory

-

Ticker Views3 days ago

Ticker Views3 days agoRight turn ahead. But where are the Liberals really going?

-

Money3 days ago

Money3 days agoWall Street tumbles as tech stocks face AI disruption fears

-

Money3 days ago

Money3 days agoU.S. stocks falling amid AI worries and weak earnings

-

Ticker Views4 days ago

Ticker Views4 days agoShould the Winter Olympics be behind a paywall?