Money

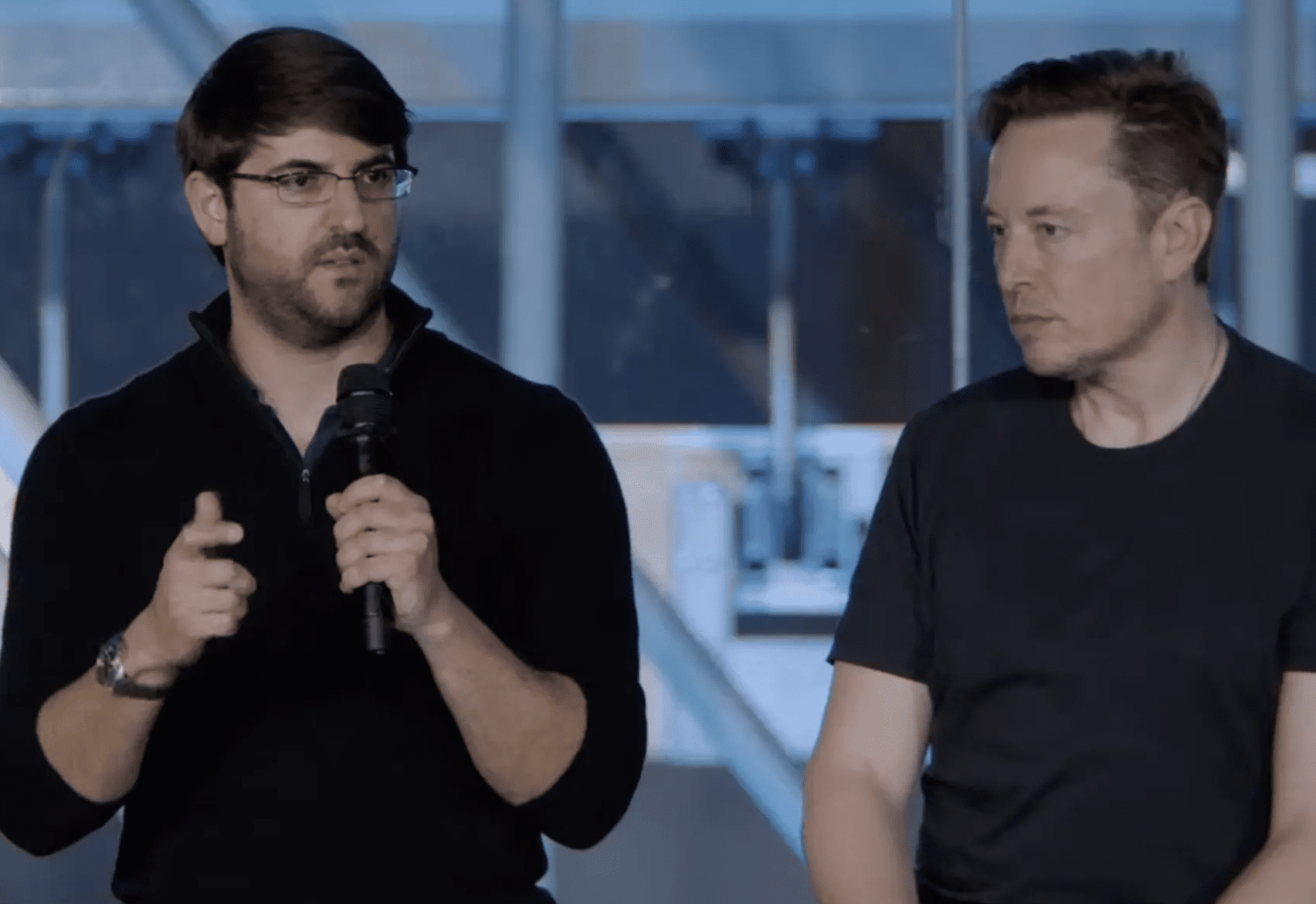

Tesla’s ‘Master of Coin’ departs unexpectedly from Elon Musk’s Electric-Car firm

Money

How to position investments for 2026: Expert advice on market cycles

As 2026 begins, strategic investment positioning and understanding market cycles are crucial for navigating today’s evolving financial landscape.

Money

Markets in 2026: Fed rates, gold surge, oil tensions & AUD strength

As 2026 begins, markets face economic shifts; gold and silver soar, while energy and currencies impact global investors.

Money

Stocks hit record high as Powell faces investigation and Trump proposes credit cap

S&P 500 hits all-time high amid Fed scrutiny; Trump’s credit card cap proposal raises investor concerns over bank profits.

-

News3 days ago

News3 days agoSendle shuts down, small businesses left scrambling

-

Ticker Views5 days ago

Ticker Views5 days agoViruses experts are watching in 2026

-

Crypto2 days ago

Crypto2 days agoCrypto climbs amid U.S. weakness and Iranian crisis

-

Ticker Views2 days ago

Ticker Views2 days agoU.S. pushes Latin American dominance

-

Money3 days ago

Money3 days agoBoeing hits seven-year high in plane deliveries as demand soars

-

News3 days ago

News3 days agoUK, Canada and Australia consider banning Elon Musk’s X over AI risks

-

News4 days ago

News4 days agoTrump declares US ready to support Iranian protesters

-

Docos3 days ago

Docos3 days agoWhy Iran’s latest protests could change the Middle East