Property

Perth’s real estate market reaches its peak – What’s next?

Perth’s real estate market peaks; Tim Graham analyzes future trends and investment insights on The Property Playbook.

Property

Blackstone acquires Hamilton Island for $1.2 billion

Blackstone acquires Hamilton Island for $1.2 billion, marking a major move in Australia’s hospitality sector

Property

Investors discover 25 top house markets for growth

New report reveals 25 Australian suburbs offering strong rental growth, affordability, and investment potential

Property

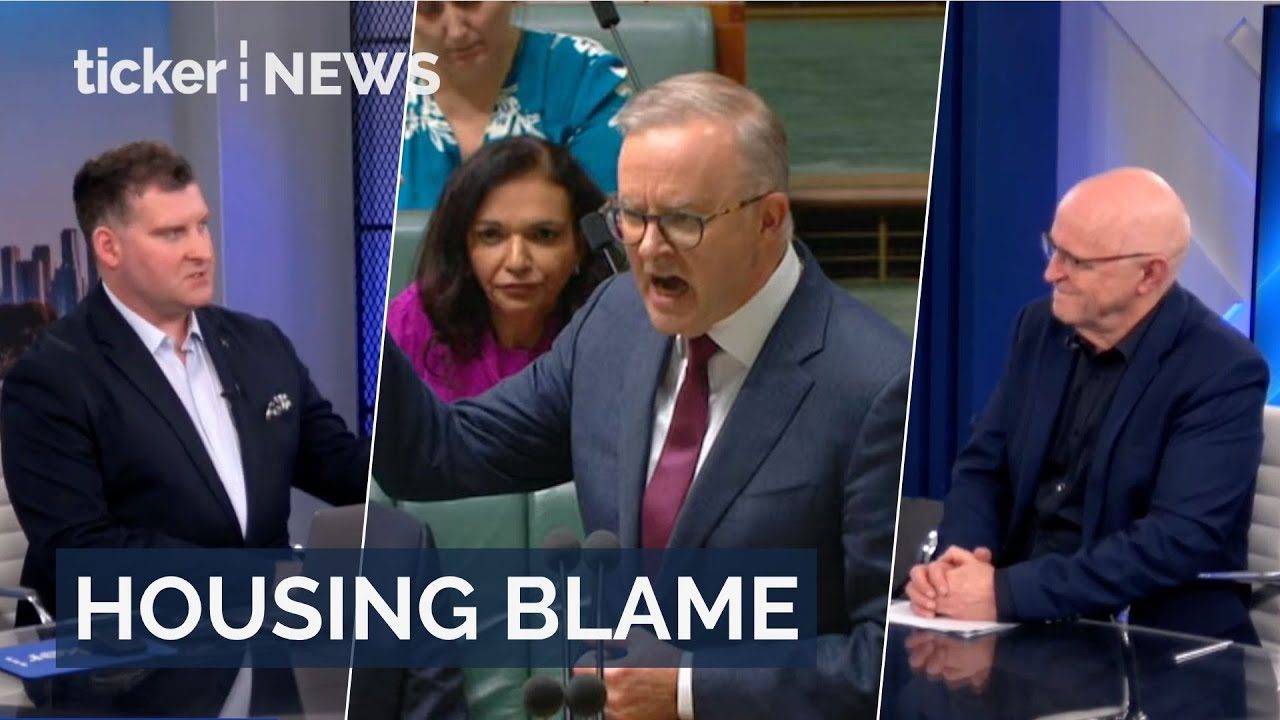

Why government policies keep driving property prices higher

“New book reveals politicians’ policies inflate property values, making homes less affordable; insights for buyers from Terry Ryder.”

-

Tech3 days ago

Tech3 days agoItaly orders Meta to open WhatsApp to AI competitors

-

Money2 days ago

Money2 days agoGlobal stocks rise to record highs in 2025

-

News2 days ago

News2 days agoNASA’s Pandora satellite set to search for alien life

-

Tech2 days ago

Tech2 days agoSoftBank plans acquisition of DigitalBridge for AI expansion

-

Politics3 days ago

Politics3 days agoNigeria disputes Trump’s genocide claims amid airstrikes

-

News1 day ago

News1 day agoIran’s currency collapse sparks mass protests as inflation spirals

-

News1 day ago

News1 day agoCIA launches first drone strike in Venezuela

-

News2 days ago

News2 days agoTrump and Zelenskyy progress on Ukraine peace plan