News

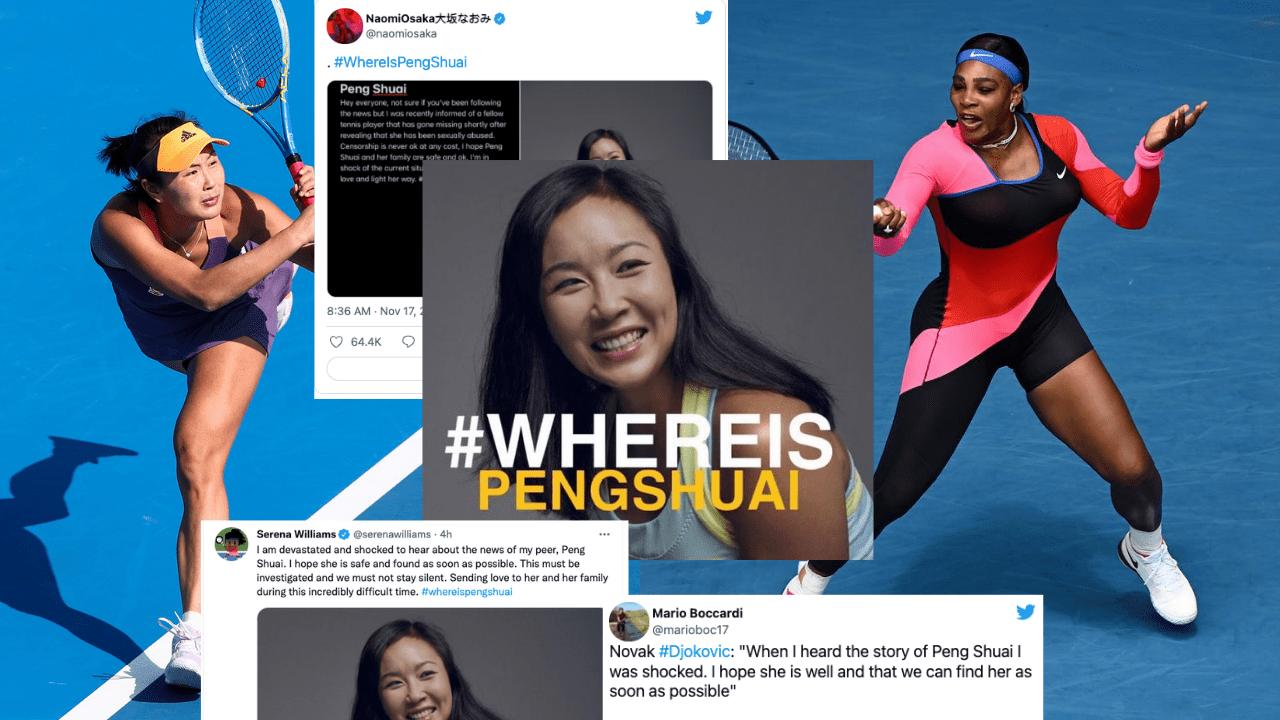

#WhereIsPengShuai – sport stars join chorus of concern

News

Notorious cartel leader El Mencho killed amid retaliatory violence

El Mencho, Mexico’s wanted cartel leader, killed in Jalisco; violence erupts nationwide, authorities on high alert.

News

Peter Mandelson arrested in London over alleged Epstein links

Former UK ambassador Peter Mandelson arrested in London linked to Epstein and alleged misconduct, denies any wrongdoing.

News

Man shot dead after breaching security at Mar a Lago

Man in 20s dies after breaching Mar-a-Lago, armed; Secret Service opened fire, citing no immediate danger inside.

-

Tech4 days ago

Tech4 days agoSam Altman predicts superintelligence could appear by 2028

-

News4 days ago

News4 days agoAndrew Mountbatten-Windsor released after 12-hour questioning

-

Money4 days ago

Money4 days agoOil hits seven-month high, and gold surpasses $5,000 amid US-Iran tensions

-

Ticker Views4 days ago

Ticker Views4 days agoPrince Andrew arrested: What it means for the Royal Family

-

News4 days ago

News4 days agoBill Gates withdraws from India AI Impact Summit before keynote

-

Leaders4 days ago

Leaders4 days agoYoung author Maya Ahmed publishes debut novel at 13

-

News1 day ago

News1 day agoIran signals nuclear concessions as U.S. talks intensify

-

Money4 days ago

Money4 days agoUS dollar strength hits NZ dollar amid FX market shifts