Money

It’s Amazon Prime Day – We’ve got you covered!

Money

Middle East crisis: Global markets, tech, and supply chains under pressure

Money

Australia’s inflation report and Nvidia earnings impact explained

Australia’s inflation report sparks market shifts, influencing interest rates, the Aussie dollar, and investor sentiment amid Nvidia’s earnings.

Money

U.S. stocks rally as AMD, Home Depot, and AI software lead gains

U.S. equities rose as AI disruption fears eased, with Home Depot, AMD, and DocuSign driving tech stock gains.

-

News4 days ago

News4 days agoCrude oil prices spike amid U.S.-Israel military action

-

News3 days ago

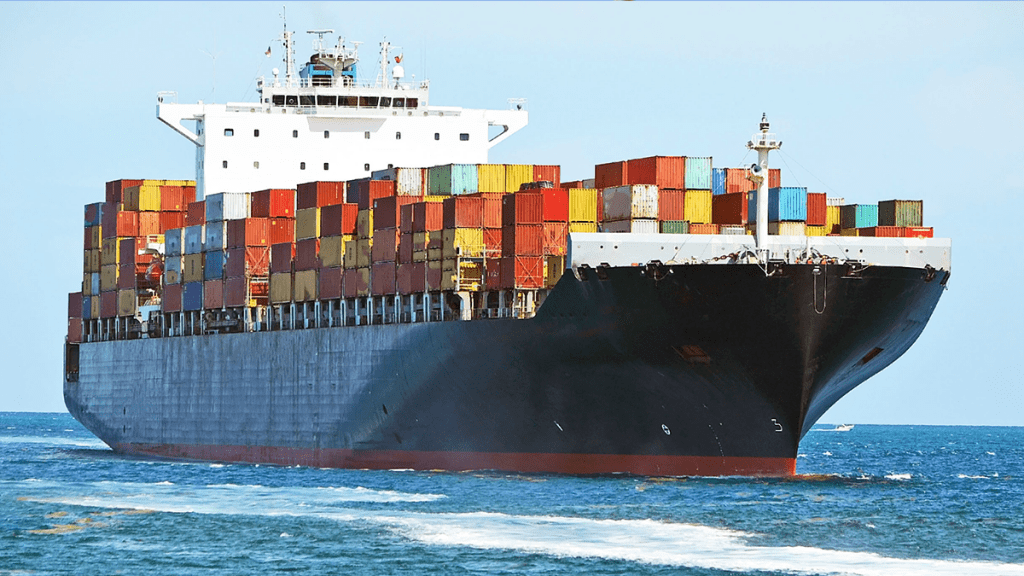

News3 days agoIran warns ships to avoid Strait of Hormuz

-

News1 day ago

News1 day agoAirlines face disruptions that surpass previous Middle East conflicts

-

News4 days ago

News4 days agoU.S. and Israel attack Iran, escalating regional conflict

-

News4 days ago

News4 days agoMarkets brace for turmoil after U.S. strikes Iran

-

Shows2 days ago

Shows2 days agoUnderstanding commercial lending’s unique challenges and strategies

-

Shows2 days ago

Shows2 days agoCities reshaped by capital, policy, and design insights

-

Leaders23 hours ago

Leaders23 hours agoNina Hargrave’s journey to Serene Body Health