Money

Is Chelsea F.C. about to run out of cash? The banks suspend credit

Money

Commodities surge as oil volatility and metals hit record highs

Oil prices fluctuate due to geopolitical tensions; precious metals soar amid inflation concerns, sparking a commodities rally.

Money

Stocks slide and Trump cancels talks: What’s next for markets and Greenland?

U.S. stocks dip; S&P 500 down 0.9%, as investors react to weak bank earnings and market volatility.

Money

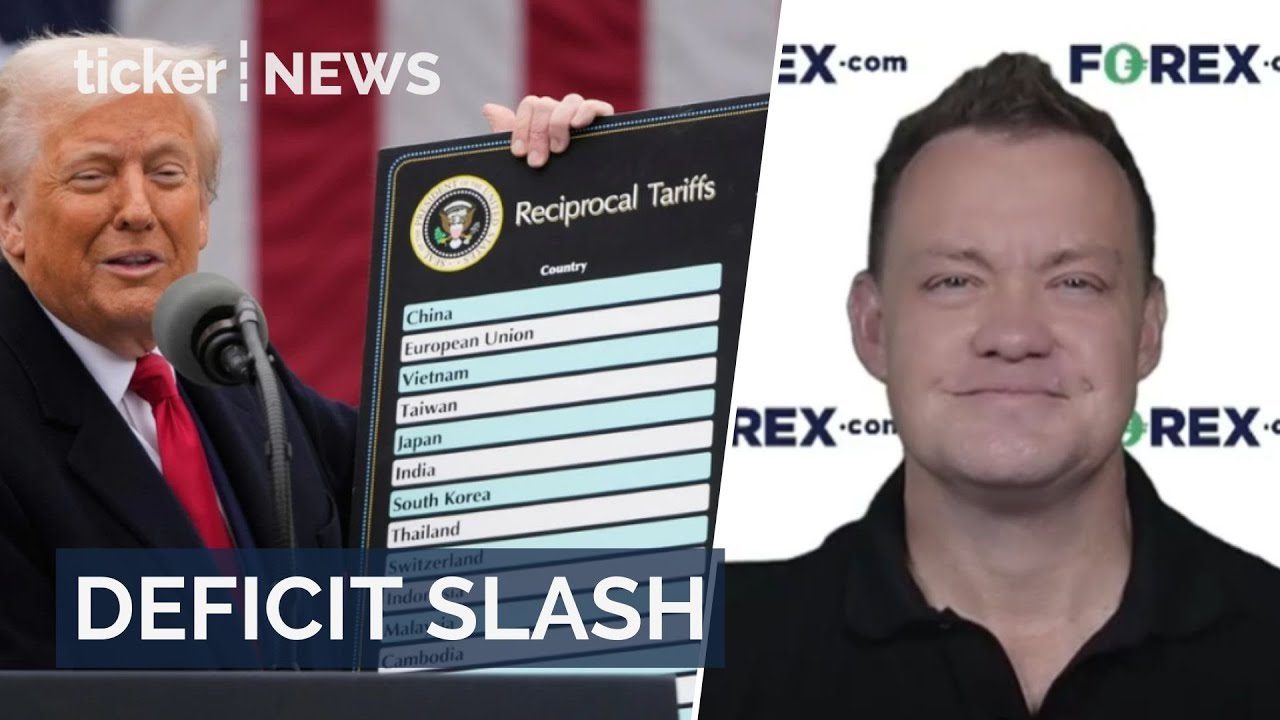

U.S. budget deficit falls to $1.67 trillion

US budget deficit falls to $1.67 trillion amid tariffs; implications of corporate taxes and Supreme Court rulings discussed.

-

Ticker Views3 days ago

Ticker Views3 days agoWhy Greenland matters in a multipolar world

-

Crypto4 days ago

Crypto4 days agoCrypto climbs amid U.S. weakness and Iranian crisis

-

Ticker Views4 days ago

Ticker Views4 days agoU.S. pushes Latin American dominance

-

Ticker Views3 days ago

Ticker Views3 days agoPentagon’s AI gamble: Is Grok safe for defense?

-

News3 days ago

News3 days agoGreenland says “No” to U.S. takeover — Chooses Denmark in geopolitical showdown

-

News2 days ago

News2 days agoIran protests and the global fight for freedom

-

Money2 days ago

Money2 days agoU.S. budget deficit falls to $1.67 trillion

-

Leaders1 day ago

Leaders1 day agoSendle’s closure impacts Australia’s small business logistics