Money

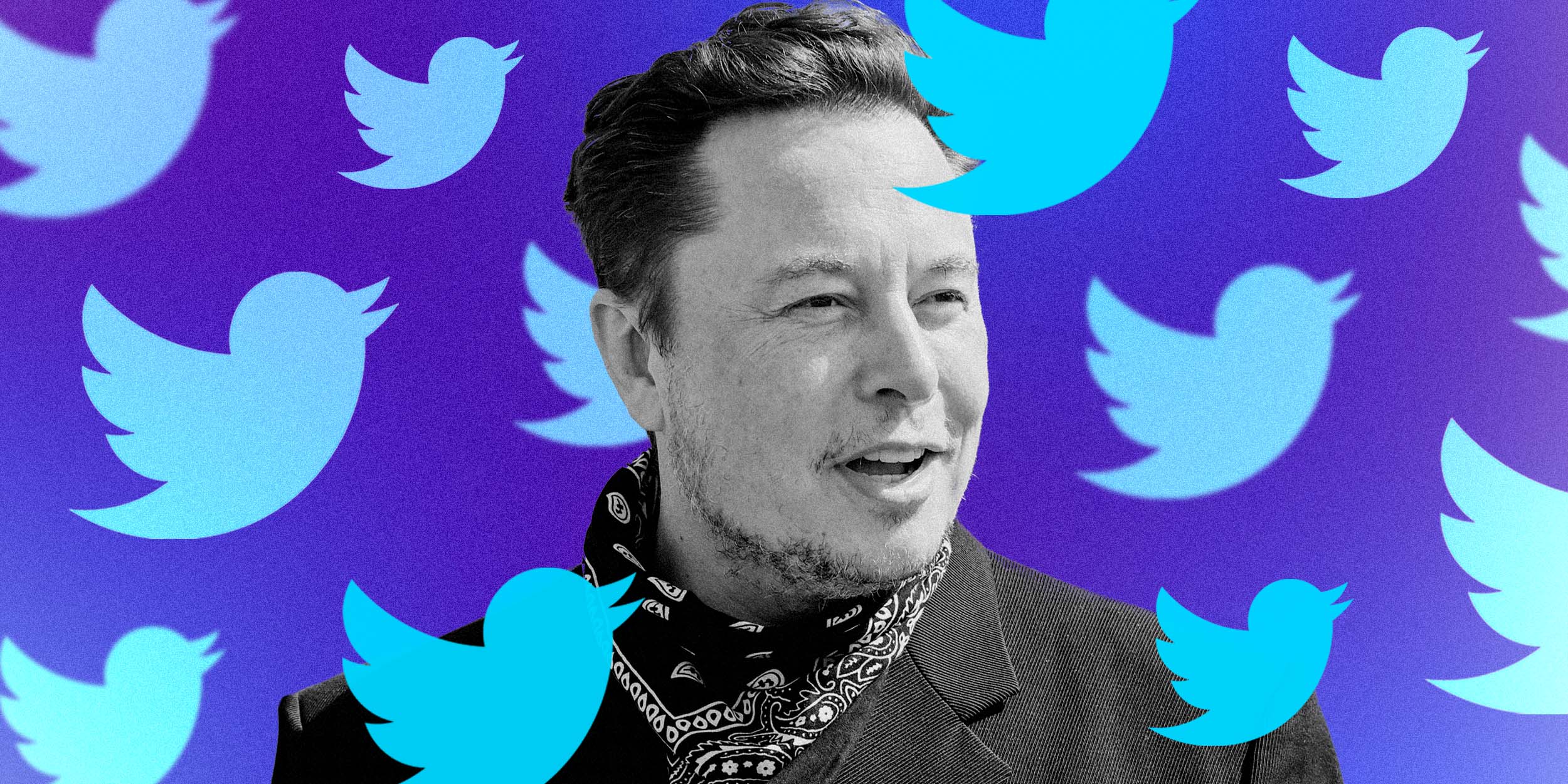

Elon Musk buys Twitter for $44 billion

Money

US dollar strength hits NZ dollar amid FX market shifts

US dollar rises amid strong US growth; New Zealand faces pressure as traders navigate volatile FX and geopolitical impacts.

Money

Oil hits seven-month high, and gold surpasses $5,000 amid US-Iran tensions

Oil prices hit seven-month high amid U.S.-Iran tensions; experts analyze impacts on global economy and energy markets.

Money

Australia jobs, market trends, and tariff ruling: What investors need to know

Australia’s jobs report shapes rate forecasts, with cyclical assets favored amid market volatility and upcoming Supreme Court rulings on tariffs.

-

Shows5 days ago

Shows5 days agoReal estate insights: Technology changes and trust remain

-

News5 days ago

News5 days agoOne Nation matches coalition as Liberal backing slides

-

Tech5 days ago

Tech5 days agoCrew-12 astronauts arrive at the International Space Station

-

Shows5 days ago

Shows5 days agoMedicinal Cannabis reform: Patient demand vs regulatory hurdles in Australia

-

News2 days ago

News2 days agoUkraine Russia peace talks stall with no breakthrough

-

Money5 days ago

Money5 days agoAI fears rattle global markets and investors

-

Ticker Views5 days ago

Ticker Views5 days agoGlobal rallies show support for Iran as sanctions and tensions rise

-

Tech16 hours ago

Tech16 hours agoSam Altman predicts superintelligence could appear by 2028