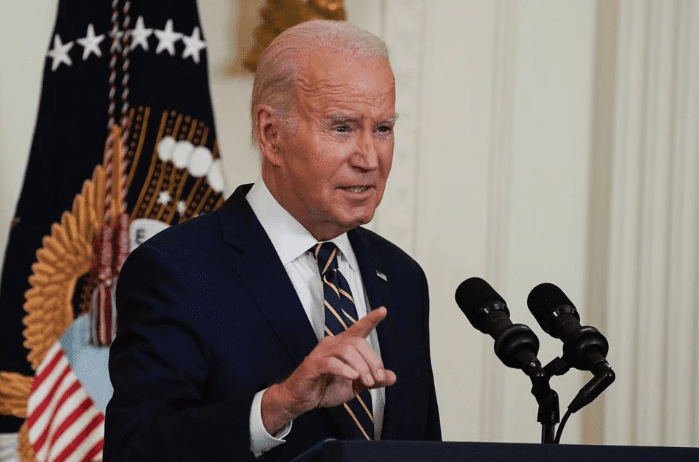

President Joe Biden signed an executive order on Wednesday that will narrowly limit specific U.S. investments in sensitive technology sectors in China.

The order also mandates the requirement of government notification for funding in other technology domains.

The long-awaited order empowers the U.S. Treasury secretary to restrict or prohibit certain American investments in Chinese entities within three sectors: semiconductors and microelectronics, quantum information technologies, and specific artificial intelligence systems.

In a letter addressed to Congress, Biden stated that he was declaring a national emergency to address the threat of advancements by countries like China “in sensitive technologies and products critical to the military, intelligence, surveillance, or cyber-enabled capabilities.”

Although the order could escalate tensions between the world’s largest economies, U.S. officials emphasized that the restrictions were aimed at mitigating “the most acute” national security risks, without intending to sever the intertwined economies of both nations.

Senate Democratic Leader Chuck Schumer lauded Biden’s directive, asserting that “for too long, American money has helped fuel the Chinese military’s rise. Today the United States is taking a strategic first step to ensure American investment does not go to fund Chinese military advancement.” He urged Congress to solidify these restrictions through legislation and further refinement.

China’s military

This order primarily intends to prevent U.S. capital and expertise from contributing to the development of technologies that could bolster China’s military modernization efforts and undermine U.S. national security. It primarily focuses on private equity, venture capital, joint ventures, and greenfield investments.

Most investments covered by the order will necessitate government notification, and certain transactions will be outright prohibited. The Treasury Department indicated that it might exempt “certain transactions, including potentially those in publicly-traded instruments and intracompany transfers from U.S. parents to subsidiaries.”

The Chinese Embassy in Washington did not provide an immediate response to requests for comments. However, the embassy had previously stated that the U.S. “habitually politicizes technology and trade issues and uses them as a tool and weapon in the name of national security.”

These regulations will apply only to future investments and will not impact existing ones.

The Biden administration stated that it had engaged with U.S. allies and partners during the development of these restrictions and plans to continue close coordination with them. The executive order reflects discussions held with the Group of Seven countries.

The implementation of the order is anticipated for next year, as informed by an individual familiar with the matter. It will undergo multiple rounds of public comments, including an initial 45-day comment period.

Regulators intend to issue an advance notice of proposed rulemaking to further define the program’s scope and initiate a comment period to gather public feedback before formulating a formal proposal.

Sources previously revealed that the restrictions on semiconductor investments are expected to align with export control rules for China established by the U.S. Department of Commerce in October.

Emily Benson from the Center for Strategic and International Studies (CSIS), a bipartisan policy research organization, speculated that investments in artificial intelligence will likely be prohibited for military purposes, while other investments in the sector will require government notification.

Tech3 days ago

Tech3 days ago

Money2 days ago

Money2 days ago

Tech1 day ago

Tech1 day ago

Tech4 days ago

Tech4 days ago

Money4 days ago

Money4 days ago

Tech2 days ago

Tech2 days ago

News2 days ago

News2 days ago

News4 days ago

News4 days ago