Money

Lockdowns throw travel plans into chaos | ticker VIEWS

Money

Big banks, inflation, and earnings: What to watch this week

Major banks and corporations report earnings this week, influencing market outlook and economic indicators ahead of 2026.

Money

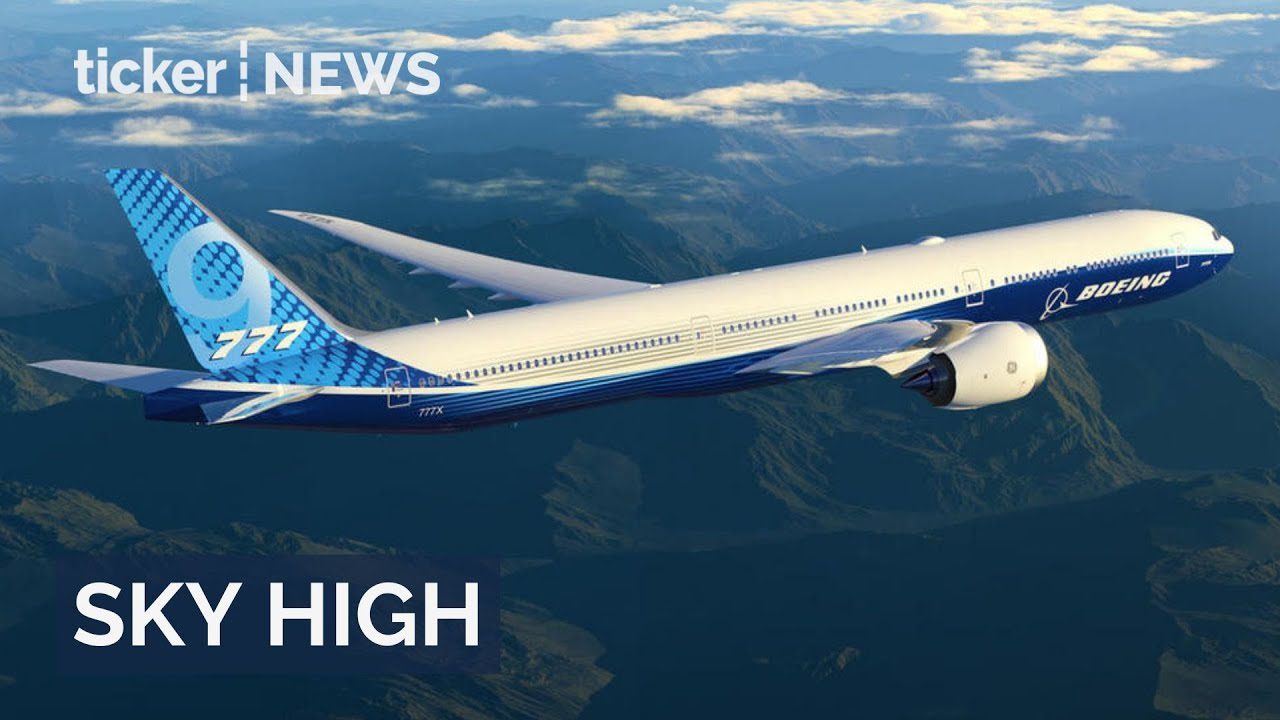

Boeing hits seven-year high in plane deliveries as demand soars

Boeing’s aircraft deliveries hit a seven-year high, bolstered by demand and new orders, including Alaska Airlines’ purchase of 105 jets.

Money

Wall Street hits record highs as markets shrug off Venezuela tensions

US markets hit record highs as investors shrug off geopolitical tensions, with the S&P 500 up 0.7% and Dow 1%.

-

Tech4 days ago

Tech4 days agoCES 2026 Highlights: AI, robotics, and the future of innovation

-

Ticker Views2 days ago

Ticker Views2 days agoViruses experts are watching in 2026

-

Crypto3 days ago

Crypto3 days agoMorgan Stanley files for Bitcoin, Solana, and Ethereum ETFs

-

Tech4 days ago

Tech4 days agoCES 2026 opens with AI powering the future of tech

-

Tech3 days ago

Tech3 days agoGlobal memory chip shortage set to drive electronics prices higher

-

News1 day ago

News1 day agoTrump declares US ready to support Iranian protesters

-

News4 days ago

News4 days agoPM initiates royal commission on anti-Semitism and unity

-

Ticker Views4 days ago

Ticker Views4 days agoIran’s leaders should take Trump’s warnings seriously. They have few options left