Tech

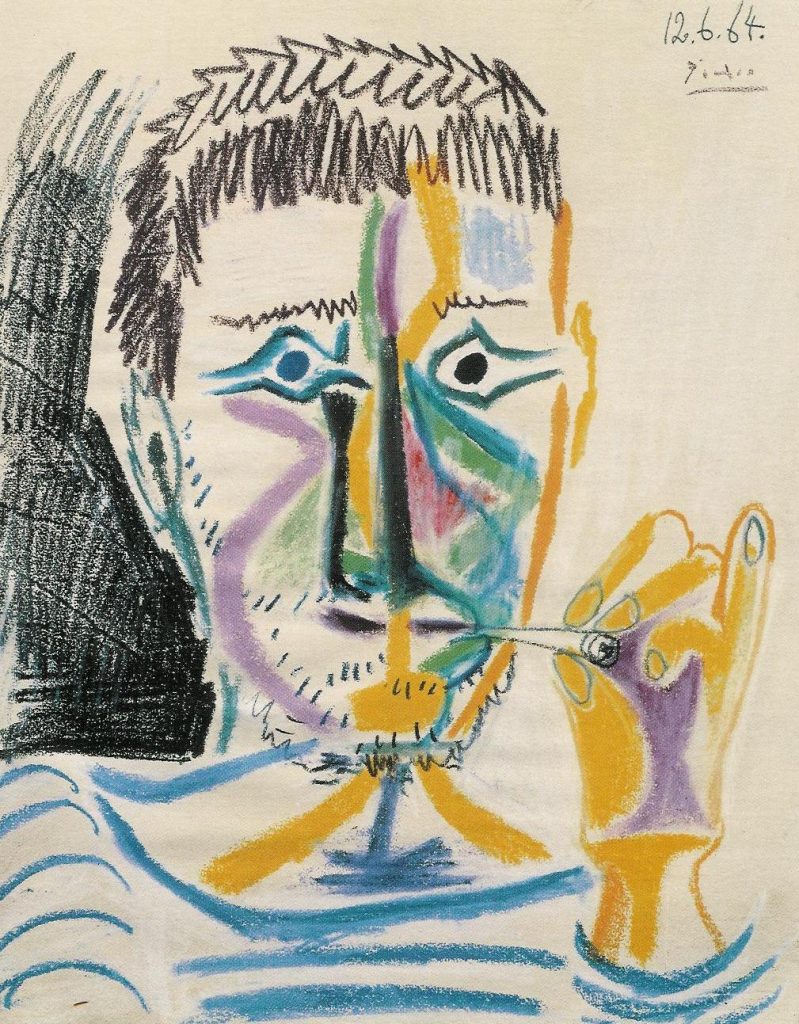

World First: how to own shares in a Picasso masterpiece

Tech

TSMC posts record profits on AI chip boom

TSMC posts record Q4 profit, driven by strong chip demand, exceeding predictions and signaling market dominance.

Tech

X restricts Grok AI as global backlash grows

X restricts Grok AI from creating sexualized images amid global backlash and regulatory concerns, aligning with UK guidelines.

Tech

AI drives memory prices higher as SK hynix and TSMC expand

Explore the rising global memory market driven by AI demand and hear insights from Brad Gastwirth on industry trends.

-

Ticker Views4 days ago

Ticker Views4 days agoWhy Greenland matters in a multipolar world

-

News5 days ago

News5 days agoGreenland says “No” to U.S. takeover — Chooses Denmark in geopolitical showdown

-

Ticker Views5 days ago

Ticker Views5 days agoPentagon’s AI gamble: Is Grok safe for defense?

-

Leaders3 days ago

Leaders3 days agoSendle’s closure impacts Australia’s small business logistics

-

News4 days ago

News4 days agoIran protests and the global fight for freedom

-

Money4 days ago

Money4 days agoU.S. budget deficit falls to $1.67 trillion

-

Ticker Views2 days ago

Ticker Views2 days agoGlobal power struggles and Arctic shipping risks

-

Tech5 days ago

Tech5 days agoAI drives memory prices higher as SK hynix and TSMC expand