Money

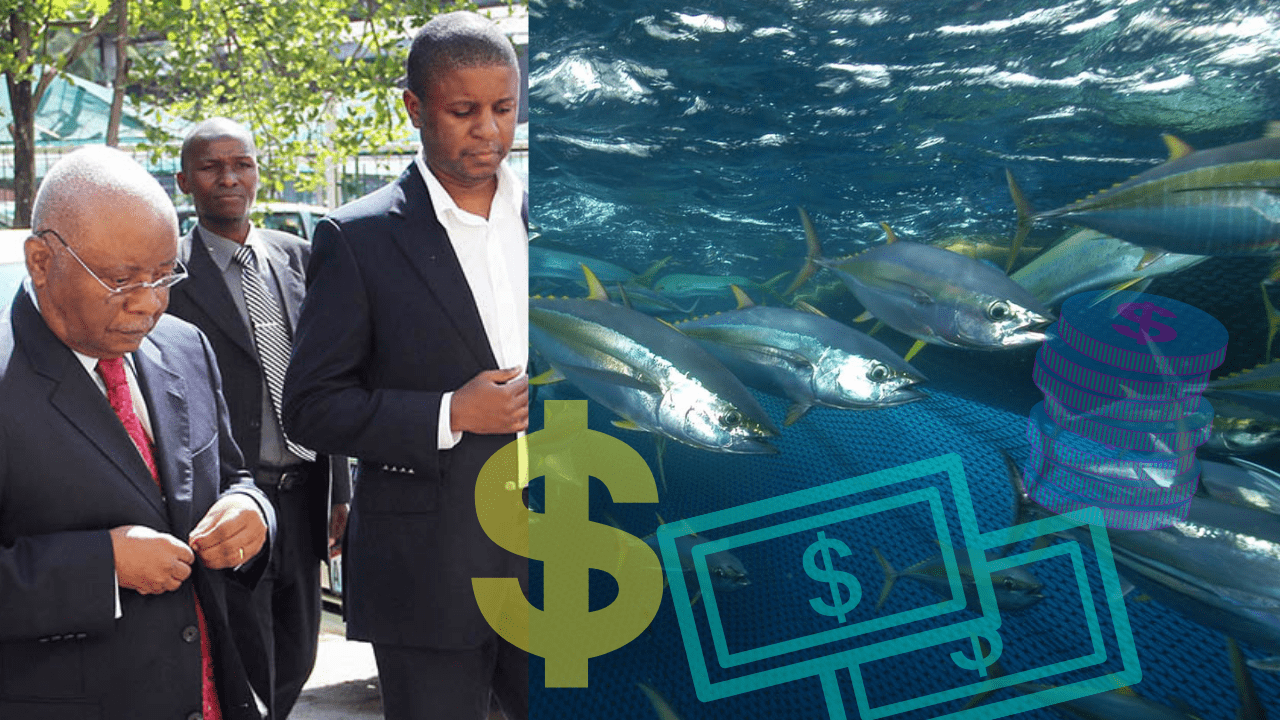

The high roller caught in a net over $2 billion tuna scandal

Money

U.S. dollar weakens while Australian dollar rises amid global market shifts

Money

Wall Street slides as AI spending raises investor concerns

Wall Street dips as AI spending scrutiny rises; Microsoft struggles while Meta thrives. Tune in for insights!

Money

Tesla brand value plummets amid Elon Musk’s political focus

Tesla’s brand value plummeted to $27.61 billion in 2025 amid Musk’s political shift, sparking investor concern.

-

Tech5 days ago

Tech5 days agoXiaomi reveals fully automated smartphone factory in China

-

News4 days ago

News4 days agoABC News Facebook hacked, porn star images posted

-

News4 days ago

News4 days agoU.S. Naval Strike Group moves into Middle East as Iran protests escalate

-

Crypto4 days ago

Crypto4 days agoBitcoin and Ethereum lead $1.7 billion Crypto market outflow

-

News5 days ago

News5 days agoMark Rutte rejects calls for a separate European army

-

News5 days ago

News5 days agoArrest made following heated speech at Sydney rally

-

News5 days ago

News5 days agoWhite House responds after second fatal shooting in Minneapolis

-

Money4 days ago

Money4 days agoTesla brand value plummets amid Elon Musk’s political focus