News

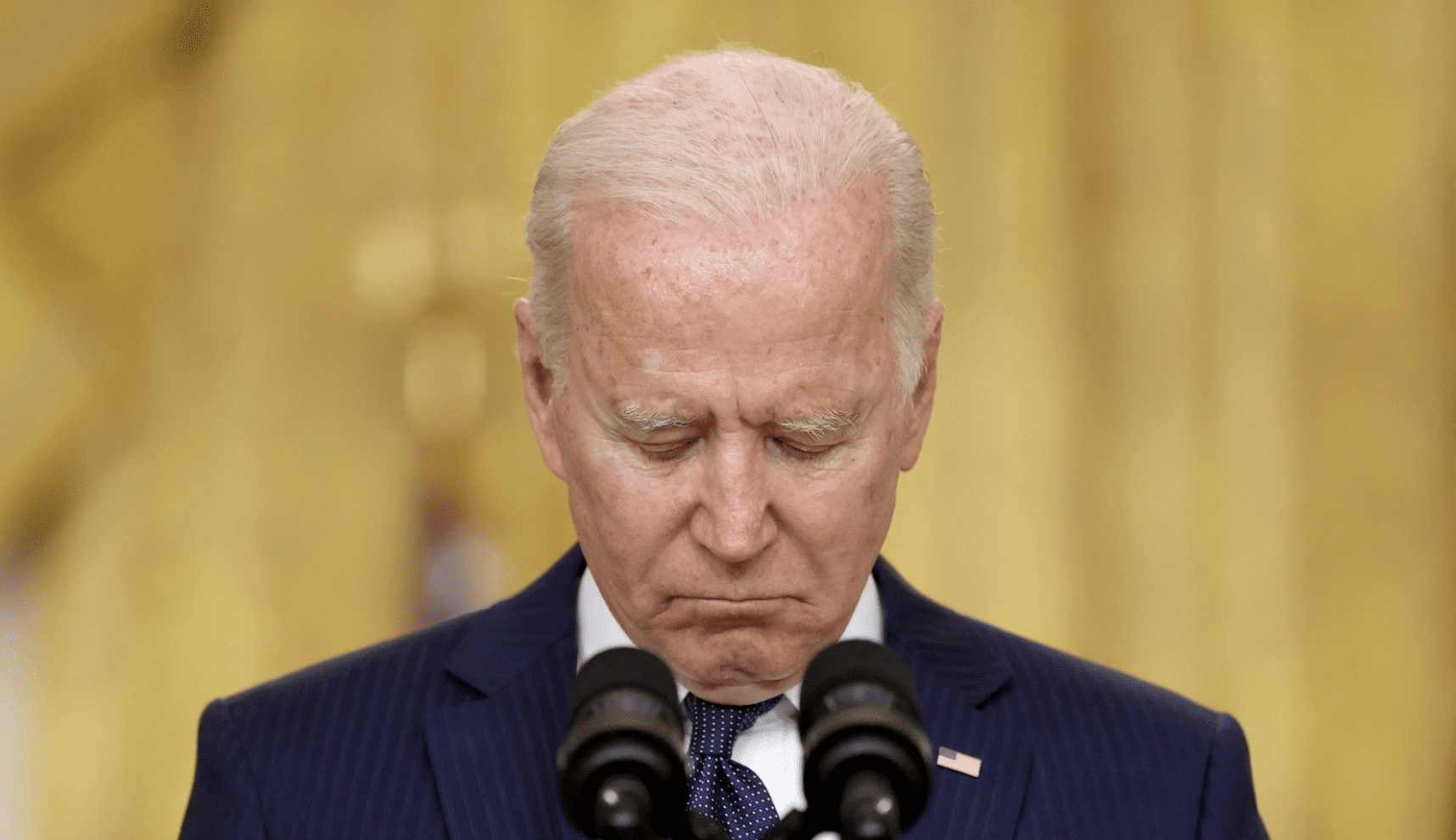

Justice department special counsel blames Biden’s forgetfulness

News

Jesse Jackson dies at 84 civil rights leader and presidential candidate

Civil rights leader Jesse Jackson, 84, dies, leaving a legacy in equality advocacy and global diplomacy.

News

Iran and U.S. reach preliminary nuclear agreement in Geneva

Iran and the US report initial progress in Geneva nuclear talks, agreeing on guiding principles but needing further negotiations.

News

Oscar winner Robert Duvall dies aged 95 leaving a towering legacy

Oscar-winning actor Robert Duvall, 95, dies, leaving a legacy that shaped modern cinema with iconic roles.

-

Shows3 days ago

Shows3 days agoReal estate insights: Technology changes and trust remain

-

News3 days ago

News3 days agoOne Nation matches coalition as Liberal backing slides

-

Tech3 days ago

Tech3 days agoCrew-12 astronauts arrive at the International Space Station

-

Money3 days ago

Money3 days agoAI fears rattle global markets and investors

-

Shows3 days ago

Shows3 days agoMedicinal Cannabis reform: Patient demand vs regulatory hurdles in Australia

-

Ticker Views3 days ago

Ticker Views3 days agoGlobal rallies show support for Iran as sanctions and tensions rise

-

Ticker Views3 days ago

Ticker Views3 days agoTrump scraps key climate law, U.S. emissions regulation at risk

-

Money2 days ago

Money2 days agoBig tech stocks slide amid AI spending concerns