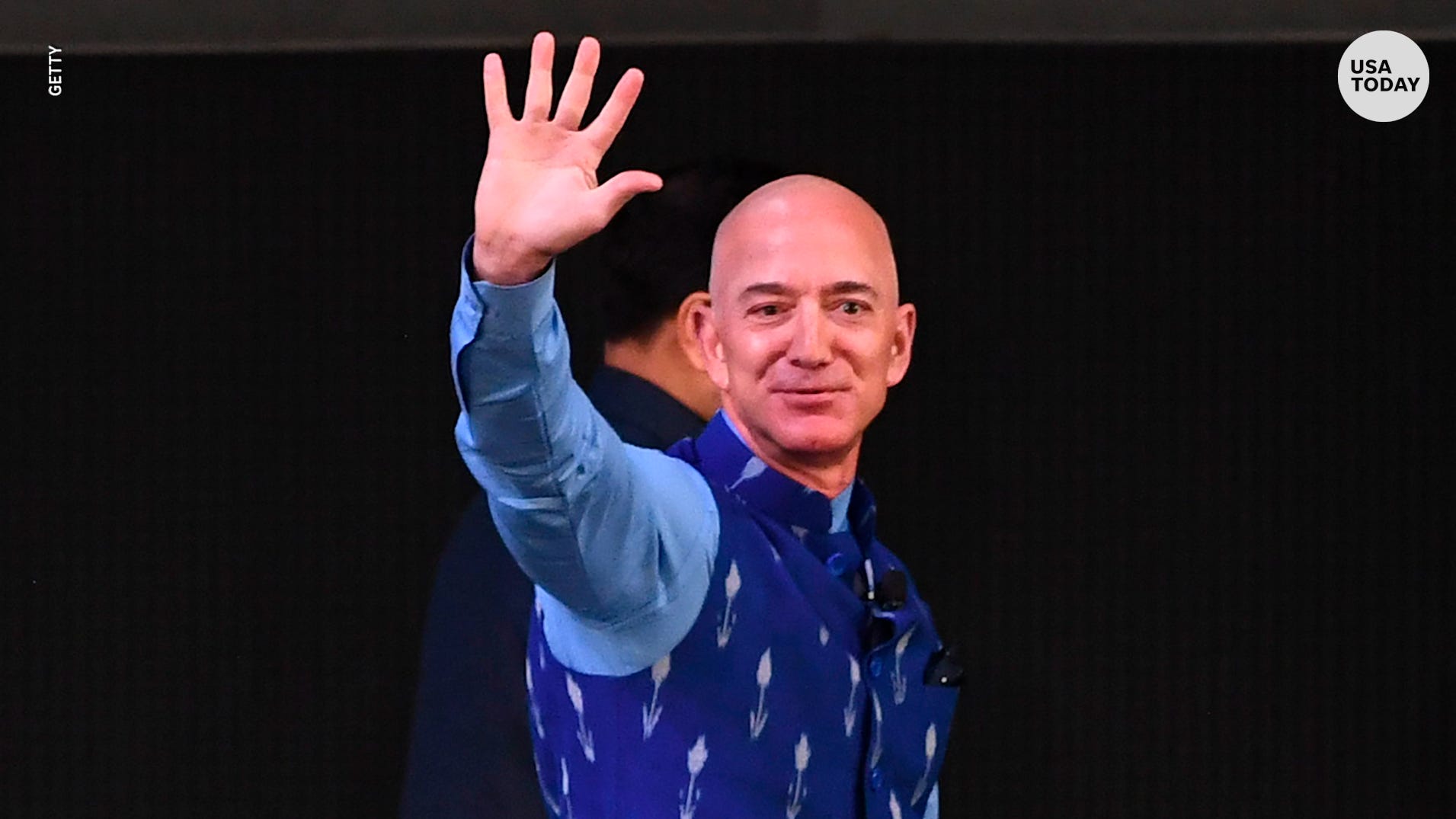

Amazon founder Jeff Bezos has handed over his CEO reins to the creator of Amazon Web Services

Jeff Bezos will officially step aside as CEO of Amazon, while Andy Jassy takes over the position.

It’s not the last everyone will see of Bezos though, he will stay on as the board’s executive chairman. However, Jassy will take on a lot of pressure, as he inherits the responsibility of the $1.7 trillion e-commerce giant.

The pressure is on for Jassy

Andy Jassy rose to his success during his time at Amazon’s cloud computing business, Amazon Web Services. He is now about to take over the e-commerce empire that employs over 1.3 million people. Amazon generates more than $400 billion a year in revenue, while still averaging an annual growth rate of 30%.

The company is more valuable than it’s ever been. Amazon is the fourth of the five big tech firms like Apple, Microsoft, and Google’s Alphabet to go beyond founder control. Each of these firms went on to reach new levels of financial success by their subsequent leaders.

This shake-up comes at a critical time for the company. The pandemic saw an increase in consumer demand like never before. However, this only shone a light on the need for heightened regulatory action into the ever-growing empire and its market dominance.

Amazon has also faced growing criticism for its treatment of workers. However, this is something Bezos has vowed to address as executive chairman.

What’s next for Bezos?

Bezos founded Amazon in his garage 27 years ago. The 57-year-old now has a net worth of $200 billion and will continue to have significant influence at the company. He will remain the largest individual shareholder. As of last month he owned around 51.2 million shares, which equates to about 10%.

It’s unclear how exactly Bezos will govern Amazon from the sidelines. But, the entrepreneur has no doubt created a legacy at Amazon. He defined Amazon’s culture as “customer obsession.” In April, Bezos told investors he would focus on new initiatives to continue to make Amazon a better place to work.

He might be stepping aside but he has plenty of other interests to occupy his time.

Outside of Amazon, he’ll spend more time with his space efforts at Blue Origin. Bezos is planning a joy ride to suborbital space with his best friend and brother, on July 20.

On his Instagram, Bezos has clearly shown his interests in Tinsel Town, posting about Golden Globe wins for Amazon Studios. During his last meeting as CEO, he spoke about re-imagining screen heroes for the 21st century through Amazon’s deal to buy MGM.

Bezos will also focus on his philanthropic efforts and ventures at the Washington Post.

Expert predictions for Amazon

Wall Street experts predict Amazon will surpass supermarket giant Walmart to become the largest U.S. company by annual sales next year. This is according to consensus estimates from FactSet.

Planning for success

Bezos stepping aside after 27 years definitely marks a new era for the e-commerce giant. It’s undeniable that he has revolutionised the streaming, shopping, technology, and internet space forever.

In his final letter to shareholders, Bezos laid out a broad vision for the company’s future, committing to extend Amazon’s famous obsession over its customers to the same level of care for its employees.

The first principle is to Strive to be Earth’s Best Employer, which is to strive for a safer, more productive, more diverse work environment. This urges leaders to ask if their employees are growing, feeling empowered and having fun.

The second principle is Success and Scale Bring Broad Responsibility, which is to strive to be humble. With a focus of the secondary effects of actions, including the planet, communities, customers, and world at large. This urges leaders to leave everything and everyone better than they found them.

Final words before stepping aside

“If you want to be successful in business (in life, actually), you have to create more than you consume. Your goal should be to create value for everyone you interact with. We are all taught to “be yourself.” What I’m really asking you to do is to embrace and be realistic about how much energy it takes to maintain that distinctiveness.”

Jeff Bezos

Ticker Views3 days ago

Ticker Views3 days ago

Ticker Views1 day ago

Ticker Views1 day ago

News3 days ago

News3 days ago

Money4 days ago

Money4 days ago

News4 days ago

News4 days ago

News4 days ago

News4 days ago

Politics3 days ago

Politics3 days ago

Ticker Views4 days ago

Ticker Views4 days ago